Published in AstroAwani, image by AstroAwani.

Malaysia is on the verge of becoming a high-income nation – the earliest by next year (2024).

Based on the World Bank classification which is updated every July 1 of the year, we remain an upper-middle income economy that’s within striking distance of crossing the threshold.

The figure updated for the current year will be retrospectively applied to the GNI per capita of the preceding year. So, for example, according to the World Bank’s “Aiming High: Navigating the Next Stage of Malaysia’s Development” (March 15, 2021), Malaysia’s GNI (gross national income) per capita was at USD11,200 in 2021, only USD1,335 short of the then threshold level that defined a high-income economy which was at more than USD12,535 in 2020. For the 2021-2022 classification, the World Bank readjusted the figure to be more than USD12,695.

However, the policy priority must also be to ensuring a more equitable distribution of wealth and income – otherwise achieving a high-income status merely based on a formula for calculating the classification that doesn’t take into account the underlying structural issues and problems would only ring hollow.

For now, Malaysia was already an upper middle-income country in 1985 (“Malaysia’s Route to Middle Income Status”, Rasiah, R. in Malaysia’s Socio-Economic Transformation: Ideas for the Next Decade, 2014) onwards.

Despite the country inching forward towards realising its lofty ambition, there are still worries that we may yet still be stuck in a middle-income trap for a few more years, especially given the inimical impact of the global geo-economic uncertainties and volatilities on our economy that remains plagued with structural issues and problems despite sound fundamentals.

What’s a middle-income trap?

The middle-income trap refers to a situation whereby a middle-income country is failing to transition to a high-income economy due to rising wages costs but declining competitiveness (“Middle-Income Trap”, Griffith B., Frontiers in Development Policy World Bank, 2011).

It means the country is sandwiched between low-wage economies on one side and more innovative advanced economies on the other (“How to avoid middle-income traps? Evidence from Malaysia”, Centre for Economic Policy Research/CEPR, 22 July 2013).

This is why for Malaysia to truly break out of the “middle-income trap”, we have to ensure that the goal of creating a high-wage and high-value economy is realised over the medium term.

This requires opportunities for upward social mobility via the creation of well-paid jobs that commensurate with the qualifications and skills obtained prior to market entry.

However, the critical need to overcome the skills mismatch structural issue by ensuring that more skilled and high-skilled jobs are created in the private sector to match the number of graduates with their respective technical qualifications and degrees each year must be equally met by adequate and inclusive social welfare nets.

In other words, the role and function of social welfare isn’t merely to prevent people from falling through the cracks but also to uplift their social mobility.

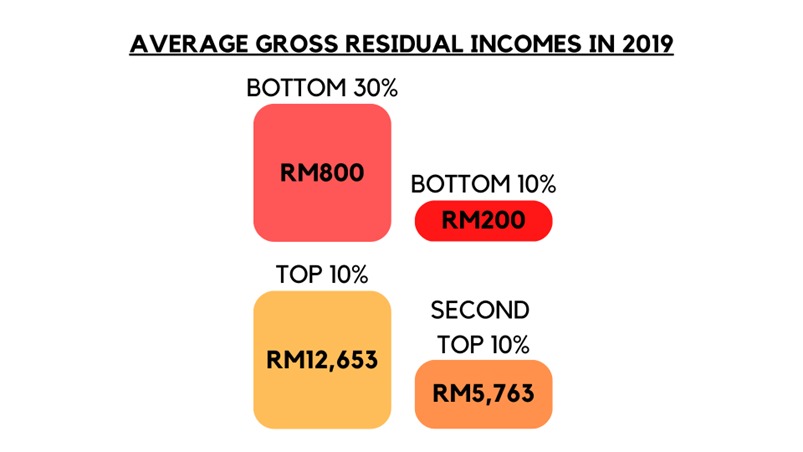

In 2019, households in the bottom 30% had average gross residual incomes below RM800 (see Figure 1). It was even lower for the bottom 10%, who only had an excess of RM200.

In contrast, the top 10% had RM12,653 in excess and, interestingly, the second top 10% had only RM5,763 – indicating evident inequalities even among top earners (“Welfare in Malaysia Across Three Decades”, Khazanah Research Institute, 2020).

Figure 1

Whilst Malaysia has an absolutepoverty rate of 5.6%, relativepoverty is remarkably higher at 16.9%. Relative poverty is when households receive 50% less than average household incomes. So, they do have some money but still not enough to afford anything above the basics.

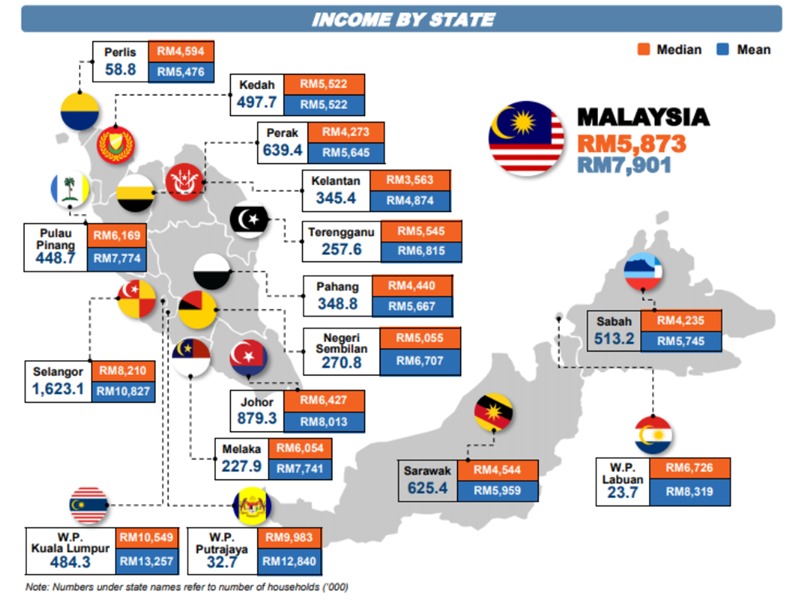

Source: Household Income and Basic Amenities Survey Report 2019, Department of Statistics Malaysia

The median household income for the whole of Malaysia is RM5,873. Only the states of W.P. Putrajaya, W.P. Kuala Lumpur, Selangor, Johor, Melaka, Pulau Pinang, and W.P. Labuan have median household incomes above this level. This leaves 6 states having median household incomes below RM5,873. Kelantan, Sabah, and Pahang are among the top 3 poorest states.

However, despite an expenditure of RM17.1 billion in 2019 (1.1% of GDP) and spread across over 60 different programmes, the policy goal still fell short in meeting minimum income or living standards (“A Vision for Social Protection in Malaysia”, Bank Negara Malaysia, 2020).

The social welfare net fragmentation brings with it a slew of complications.

These include the overlapping of similar and identical services and, by extension, the duplication of ministerial purview as well as database management and, consequently, leakages (double dipping) and inclusion/exclusion errors.

The lack of aligning complementary active labour market policies (ALMPs) with social welfare nets also entrenches overreliance.

Intergenerational poverty (the vicious cycle of poverty) will be perpetuated unless the vulnerable are inherently empowered to upskill and improve their social mobility.

Thus, ALMPs such as incentive-based vocational training and State-backed provision of child-care support are instrumental in empowering the target groups to graduate from social welfare and achieve upward social mobility. Additionally, this would ensure the fiscal sustainability of social welfare.

It’s time for Malaysia to revamp its social welfare framework by taking inspiration from developed nations across the world. Nations with high rankings of upward social mobility and low levels of inequality don’t achieve this merely through broad cash handouts or similar short-term fixes of the like.

There’s something structurally and systemically different in the approach. For example, Iceland is a Nordic country with the world’s lowest poverty rates of 0% in 2017, and 4.9% in 2021.

Though Nordic countries have a starkly different geography and history to Malaysia, they employ a unique combination of social welfare and capitalism that’s worth taking some inspiration from. For simplicity purposes, Iceland will be used as an example for comparative illustrations.

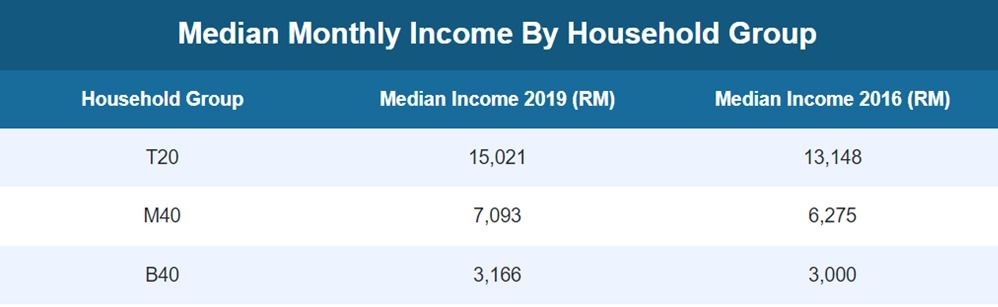

Figure 2

One can’t discuss social welfare without also discussing taxes as it’s the government’s main source of revenue to fund these initiatives. Iceland has a tax revenue to GDP ratio of 35.1% and a government expenditure to GDP ratio of 49.2%. Meanwhile, for tax revenue to GDP ratio and government expenditure to GDP ratio, Malaysia has 12.9% and 12.8%, respectively.

It’s also worth noting that despite the high government expenditure to GDP ratio of Iceland, it still has a fiscal surplus of 7.9% of GDP whilst Malaysia has a fiscal deficit of 4.7% (or, a surplus of – 4.7%). A huge reason behind the weak tax revenue to GDP ratio for Malaysia may be due to the informal sector (those who are self-employed or are in the “shadow” economy).

With 57% of employment being informal, this that many among 3.5 million workers are unprotected by EPF and SOCSO, not contributing to government income tax revenue, and also less able to receive social welfare benefits as they aren’t captured by the LHDN database. This reveals a huge oversight in Malaysia’s social welfare system.

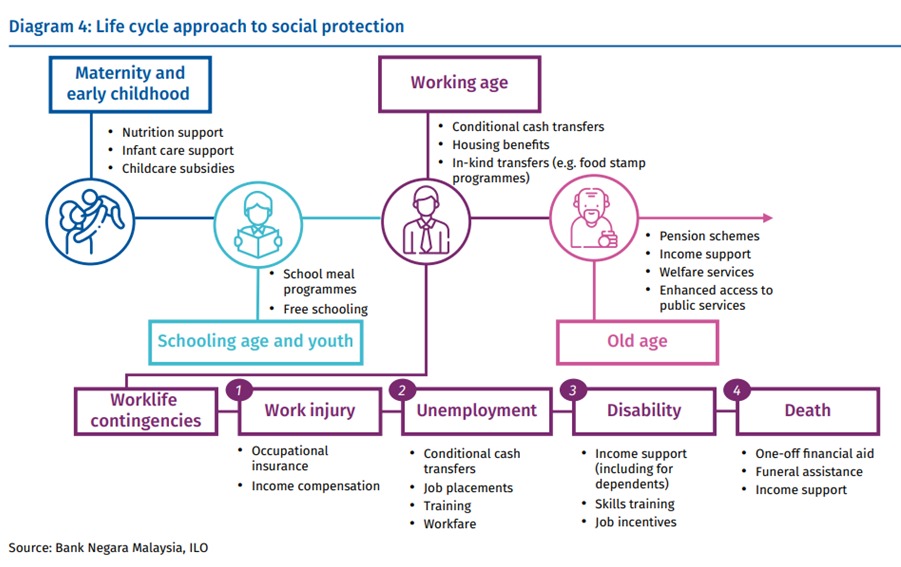

A Comprehensive Approach to Social Welfare: The Lifecycle Approach

In glaring contrast to the poor relief approach, the lifecycle approach to social protection emerged in many European countries as a more comprehensive approach to social protection. It reflects the fact that people face different risks and vulnerabilities at different stages of their lives, and that social protection can be tailored to address these risks at each stage. It is a basic social protection provision for citizens from cradle to grave.

Cash handouts or income-level-targeted assistance may be effective in the short-term as they allow for individuals to satisfy immediate needs and urgent purchases.

However, it does little to set them up towards achieving social mobility in the long-term as the factors of insufficient education/skill levels or family commitments are unaddressed. In other words, the development of human capital is the only real way out of the poverty trap.

Should there be a lifecycle-approach-based social welfare scheme as illustrated in the diagram above, together with the cash handouts specifically for a complementary ALMP, this would effectively free up individual capacity to take the necessary steps (such as upskilling/reskilling/continuing education) to graduate from social welfare net programmes and eventually, escape the poverty trap and improve one’s financial standing.

To enable the construction of a lifecycle approach to social welfare in Malaysia, EMIR Research recommends the following policies (among others):

- Consolidation of all social welfare schemes/programme and their alignment with ALMPs

The consolidation of all social welfare schemes/programmes would also allow for more effective integration with ALMPs (to also combat urban poverty).

For example, the introduction of special cash scheme – conditional transfer – could be given to gig economy workers such as delivery riders (p-hailing) to make the transition to a higher paying job by supporting their reskilling and upskilling efforts. This could then be consolidated with the unconditional cash transfer (UCT) schemes such as the current Sumbangan Tunai Rahmah (STR) – whereby the former (conditional cash transfer) can be synchronised with the latter so that the STR can be gradually reduced over time and completely ended once the transition to a higher paying job is completed.

- EPF–PRS strategic pooling and synergy

The predicament is that the informal sector, especially the gig economy is growing.

A possible model that could be explored would then be the pooling of funds from EPF and the PRSs (private retirement schemes) to enable higher returns on the back of a bigger and stronger investing power.

Fund pooling also enables a larger and more diversified portfolio investments, especially in terms of mutual funds (thus, expanding investment opportunities) and equities such as exchange traded funds/ETFs and futures (which helps to hedge ETF investments and can also help to stabilise and reinforce expectations regarding prices of commodities – as an integral aspect of our food security, in turn).

In addition, annuities (fixed and variable) could also be provided to ensure that those who retire without adequate retirement sum but have the minimum funds to invest can still expect to receive regular or periodic payments to fund their life-style through their remaining life expectancy.

Thus, the EPF and PRSs strategic synergy could also enable retirees to tap into the expertise of the latter in providing annuity schemes.

Hence, strategic collaboration between the EPF and PRSs would definitively complement and supplement the wider social welfare protection system by ensuring that retirement savings of B40 and lower M40 contributors can be rebuilt pre- and post-retirement.

- Basic State Pension/Universal Basic Pension (BSP/UBP)

As advocated in EMIR Research article, “Mix and match” – moving beyond the EPF” (October 29, 2021), there’s a need to consider a BSP/UBP.

Those who retire with a retirement sum shortfall as prescribed by the EPF and doesn’t qualify to buy an annuity can draw from the BSP/UBP (tax-free) run by an administrator.

A systematic and comprehensive approach is needed to ensure that the government’s desired policy objectives to uplift the socio-economic status of the lower income as well as fiscal sustainability can be effectively met.

In the final analysis, social welfare must be aligned with social security so that both are mutually complementary and reinforcing.

Jason Loh and Jennifer Ley Ho Ying are part of the research team at EMIR Research, an independent think tank focused on strategic policy recommendations based on rigorous research.