Published by AstroAwani & BusinessToday, image by BusinessToday.

Malaysia as ASEAN’s gateway to innovation is a vision rooted in more than just branding. Strategically positioned for a 680-million-strong market—two-thirds of whom are under 35—it is well placed as both a testbed for emerging technologies and a regional launchpad. This promise was bolstered in 2024 when Malaysia rose to 33rd in the Global Innovation Index (GII)—its best performance since 2016. Yet, gaps remain in R&D commercialization, talent retention, and policy alignment. To fully harness data centers, AI, and the wider digital economy, Malaysia must bolster R&D pipelines, retain top talent, and ensure sustainable growth.

Being situated at ASEAN’s geographic center gives Malaysia unparalleled market reach. Its cross-border connectivity allows businesses to pilot new solutions locally before scaling them across a youthful, tech-savvy population of 680 million. This positioning naturally makes the country a prime testbed for regional innovation.

Malaysia’s “active neutrality” policy enables it to partner with both Eastern and Western powers for diversified investments and technology transfers. Amidst growing U.S.–China tech tensions, this balanced approach provides strategic autonomy. Recent data center commitments from Microsoft and other Asian firms highlight how Malaysia mediates and benefits from global cooperation in cloud computing, AI, and other digital infrastructure.

Moreover, over the past few years, Malaysia’s digital economy has attracted significant capital inflows, projected to exceed US$31 billion in gross merchandise value by 2024. Microsoft’s US$2 billion investment in Johor exemplifies this trend, not only driving infrastructure development but also signaling strong international confidence. The resulting capital infusion boosts multiple sectors—from fintech and e-commerce to healthcare and agriculture—creating a robust ecosystem for tech entrepreneurship.

Singapore’s 2019 moratorium on data centers opened the door for Johor to emerge as a regional hub. Projections suggest Malaysia’s data center capacity could expand sixfold over the next five years, though sustainability must remain a priority. Balancing energy use, embracing renewables, and possibly deploying small modular nuclear reactors (SMRs) will be critical to ensuring that this data center surge bolsters, rather than burdens, the nation’s digital infrastructure.

Furthermore, government-led initiatives like MyDIGITAL and the MySTIE framework, along with the National AI Office, demonstrate a strong commitment to shaping Malaysia into an innovation powerhouse. TiPM—Malaysia’s leading innovation facilitator—has accelerated over 160 startups via the National Technology & Innovation Sandbox (NTIS), showcasing how coordinated efforts between public bodies and the private sector promote adoption of emerging technologies.

Finally, as ASEAN’s chair in 2025, Malaysia can champion a more digitally cohesive region. By shaping data governance standards, promoting cross-border R&D, and crafting policies for talent mobility, the country can set the tone for ethical AI, sustainable data centers, and quantum security initiatives. This leadership role opportunely places Malaysia at the forefront of defining ASEAN’s technological future.

Promising Sectors for Tech-Driven Growth

AI could add an estimated US$115 billion to Malaysia’s GDP by 2030, affecting not only manufacturing but also sectors such as healthcare, agriculture, and finance. Realizing these gains demands robust digital infrastructure, ethical AI governance, and dedicated investment in research and skills training.

Malaysia’s data center expansion, particularly in Johor, is poised to make the country a major regional hub for data storage. Yet the energy-intensive nature of these facilities raises environmental concerns that must be addressed. Initiatives could include adopting renewable energy, advanced cooling techniques, and exploring SMRs to power these facilities sustainably. By maintaining an open stance through active neutrality, Malaysia can attract both Western and Eastern cloud providers, ensuring healthy competition, technology transfer, and diversified investment.

Penang has long been a linchpin in the global semiconductor supply chain, specializing in assembly, testing, and packaging. The next step is to move up the value chain—into wafer fabrication, integrated circuit design, and robust R&D. This requires government-industry partnerships that provide tax incentives, specialized upskilling programs, and new R&D facilities. By focusing on higher-value activities, Malaysia ensures its place in the global tech ecosystem, mitigating the risks of over-reliance on lower-margin manufacturing.

Quantum technology represents the next frontier, and several countries already have national quantum strategies in place. Malaysia should move quickly to establish, for example, a National Quantum Council under MOSTI, build on prior MIMOS research, and form partnerships with other quantum leaders (such as Singapore, China, Russia, and Japan). From post-quantum cryptography to advanced sensing technologies, the potential applications are vast—and so are the risks of lagging behind.

Overcoming Key Barriers

Despite increased research activity, only around 3% of Malaysia’s academic outputs reach the market—well below the 10% global average. Commercialization expertise and viable distribution channels remain the biggest gaps.

To enhance commercialization, universities should bolster their tech-transfer offices and incorporate marketing and commercialization expertise into R&D from the outset. Mandating at least 30% industry representation on grant boards can bring market insights to research decisions, while revised key performance indicators (KPIs)—prioritizing patents, spin-offs, and licensing over publication volume—ensure academic work aligns more closely with industry needs. There is also a need to expand policy sandboxes (like the NTIS) to fast-track regulatory approvals for promising spinoffs.

Malaysia’s modest standing in GII knowledge and technology outputs highlights systemic fragmentation. Despite a strong pipeline of science and engineering graduates, a skills-to-industry mismatch weakens competitiveness. Low R&D wages (0.5% of GDP), weak industry-academia links, and structural issues—limited career growth, wage gaps, and stagnant R&D—fuel brain drain. Addressing this requires a “radical talent retention revolution” (see How to Make ‘Brain Gain’ Programs Work, Malaysian Brain Drain: Voices Echoing Through Research), including:

- Competitive salaries and equity incentives for high-demand roles in AI and quantum computing.

- More robust industry-academia collaboration, including sabbaticals in industry and performance-based research funding.

- Clearer career pathways and engaging local R&D opportunities for scholarship recipients.

- Better governance reforms—based on need, merit, and transparent data—so that top talent sees genuine prospects at home.

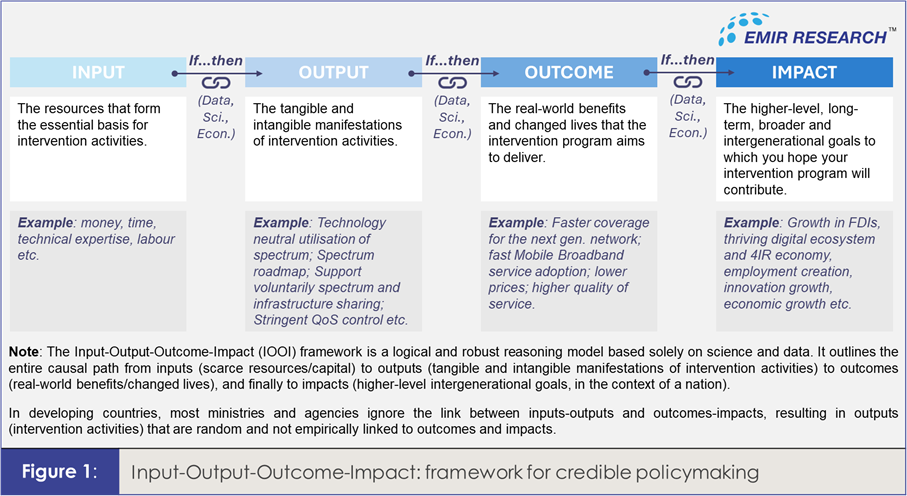

While Malaysia ranks highly in startup financing (Global Innovation Index historical data), real capital formation (GCF) remains low, with investments favoring property over deep tech and infrastructure—fragmented ecosystem and financing mismatch that stifles innovation. A key weakness is the absence of an Input-Output-Outcome-Impact (IOOI) framework (Figure 1), which not only hampers efficient resource allocation but also limits insights into nationwide talent and innovation distribution—an area where leading innovation-driven economies excel.

Thus, instituting IOOI would shift the culture and mindset toward measuring what matters—tracking R&D returns, linking funding to commercialization milestones, and leveraging blockchain for transparent outcome-tracking. Its institutionalization could also create real prospects for top talent, including expats.

Similarly, the Single Wholesale Network model fiasco in 5G rollout highlights the risks of neglecting IOOI-driven policymaking. Malaysia needs transparent, pro-innovation governance with strong frameworks for IP protection, cybersecurity, and ethical AI to reduce investor uncertainty. The government should also lead by example—adopting AI-driven solutions within public services to create early demand and demonstrate the viability of emerging technologies.

Showcasing at MWC 2025 and Beyond

Malaysia’s presence at Mobile World Congress (MWC) Barcelona in 2025 offers a prime opportunity to highlight its success stories. Rather than merely pitching generic potential, the country should present tangible outcomes:

- Data Center Boom in Johor: Illustrate how Microsoft’s US$2 billion investment spurred both infrastructure development and job creation.

- 5G Use Cases: Showcase TiPM’s 5GX Centre’s proven pilots in agriculture and public safety.

- Active Neutrality in Action: Position Malaysia as a “Switzerland of AI” by hosting leading tech companies from the U.S. (Google, Microsoft) while also engaging Chinese partners in open-source AI.

- ASEAN Gateway: Emphasize the youth-driven 680-million market waiting for new technology solutions. With ASEAN Chairmanship in 2025, Malaysia can advocate for a cohesive digital bloc and lead dialogues on ethical AI, data governance, and quantum security.

- Talent Magnetism: Unveil incentive packages—perhaps, like “Digital Nomad Valley” with tax holidays or equity-based visas for AI founders—to attract global talent and possibly reverse brain drain.

Becoming ASEAN’s “Gateway to Innovation” is not a foregone conclusion—it demands ongoing reforms in both mindset and policy. By steadily refining its strategies, attracting global expertise, and demonstrating tangible commercial results, Malaysia can bolster its position as a key innovation player in the region.

Dr Rais Hussin is the Founder of EMIR Research, a think tank focused on strategic policy recommendations based on rigorous research.

由e南洋刊登

(吉隆坡4日讯)埃米尔研究机构(Emir Research)预计,人工智能将在2030年前马来西亚国内生产总值(GDP)贡献1150亿美元(约5131亿令吉),不仅惠及制造业,也将造福医疗、农业和金融等多个领域。

该机构主席拿督莱士胡欣博士今日指出, 要实现这一增长,大马必须加强数字基础建设、制定完善的人工智能监管政策,并加大在研究和技能培训上的投入。

大马可引领区域发展

“作为今年的东盟轮值主席国,大马可引领区域发展,例如制定数据管理标准,推动跨国研发,促进人才流动,并加强人工智能伦理、永续数据中心及量子安全技术。”

他在文告中指出,大马的数据中心产业正在迅速发展,尤其是柔佛,有望成为区域数据存储中心。

“然而,数据中心的高耗电量带来环境挑战,需要通过可再生能源和先进冷却技术来解决,并探讨使用小型模块化反应堆(SMR),来提供稳定的绿色能源。”

他表示,通过保持积极中立的开放立场,大马可吸引东西方的云计算供应商,确保健康竞争、技术转移和多元化投资。

他也说,槟城长期以来一直是全球半导体供应链的重要枢纽,专注于组装、测试和封装,而下一步是向价值链上游迈进,涉足晶圆制造、集成电路设计以及强大研发。

“这需要政府与工业界合作,包括提供税收奖掖、专业技能提升计划和新研发设施。”

他说,专注于更高价值的活动,大马能够在全球科技生态系统中占据一席之地,降低对低盈利制造业的过度依赖风险。