Published by Astro Awani, image by Astro Awani.

Since the idea of #undibanjir was first advanced in mid-September 2022, the ringgit Malaysia has accelerated heading south. The pair appears to have no fundamental strength left unless a miracle can happen and Malaysia’s “policymakers” can finally put forward a credible action plan for resuscitating the nation.

The USD/MYR price pattern articulately states where reality stands versus the pure narrative management talks about “fairly strong reserves”, “economy on the right footing” with “stronger economic or trade growth” (on extremely low base though), “weak ringgit benefitting our exporters” and finally, yet another unsustainable feudal budget.

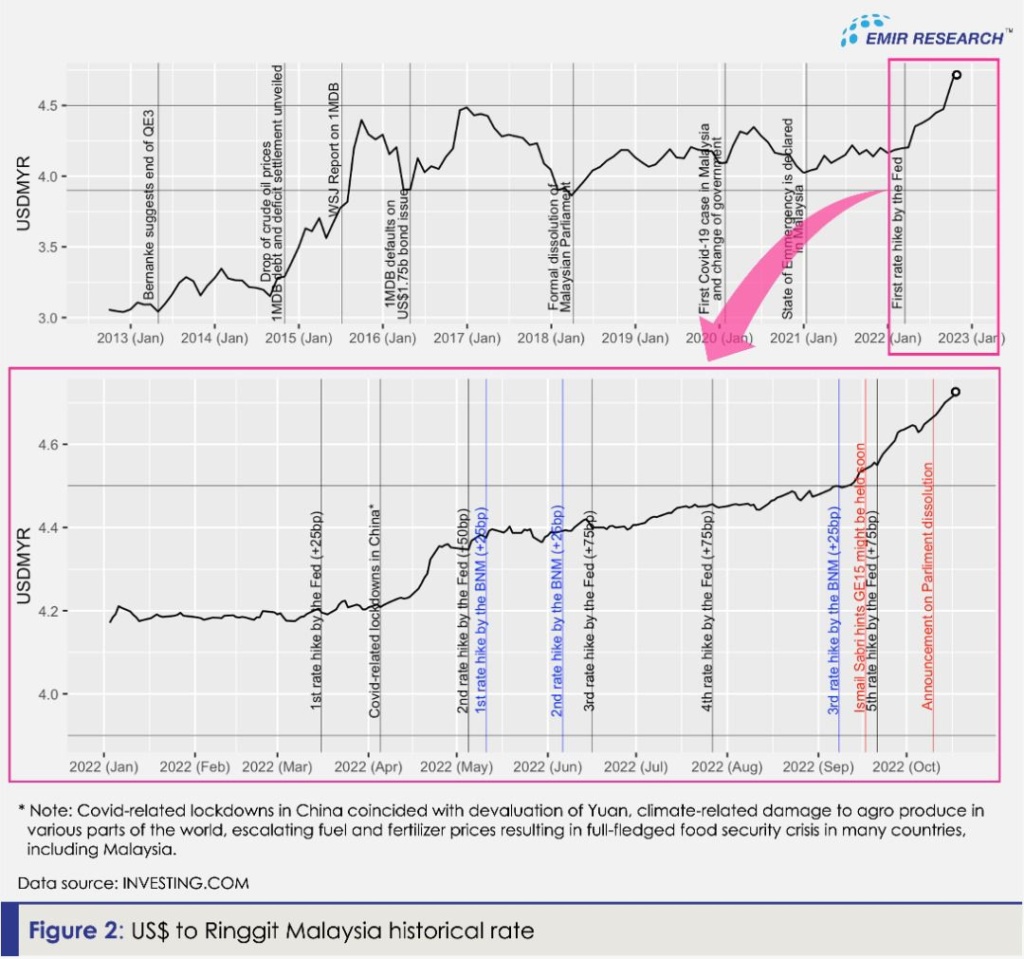

EMIR Research has warned as early as end-2021 that the ringgit appears to be poised for serious depreciation after a year of ranging, based on technical analysis and fundamentals (refer to “Ringgit open for downward speculative pressure?” from December 20, 2021).

In this article, EMIR Research drew attention to the critical factors placing currency in a weak position, such as depleting international reserves, continuously sliding exchange rate, especially in combination with the belief that this general trend will continue (based on the country’s fundamentals), expanding domestic credit (public and private), and domestic inflation. These factors could have been observed in Malaysia for some time and were ignored only by policymakers but not the investors, entrepreneurs, local human capital etc.

And EMIR Research particularly stressed that even more than all the above factors, it is the political instability, weak national governance, inconsistency and uncertainty of national policies and lack of strategic direction for the country that always hurts domestic currency the most, as considerable empirical evidence in the academic literature suggests.

EMIR Research then reiterated, once again, in a more recent article, “RM Meltdown — Preparing for the Worst”, from September 21, 2022, the following idea. Should there be more talks about holding the elections (at that time, the idea was just voiced out) some more during the expected particularly adverse flood season, technically, nothing is stopping the ringgit from reaching RM5 per 1 US dollar, probably, finding an intermediate resistance around the RM4.8 per 1 US dollar level (Figure 2) unless there is a fundamental reversal in the form of credible policymaking and lessened politicking.

Now, after almost one month, we are less than 10 cents away from RM4.8 per 1 US dollar level (round number close to all-time historical low — huge psychological level), and #undibanjir is, unfortunately, certain.

Yes, the hawkish US dollar hurts almost all currencies.

Yes, there are currencies of even more robust, developed economies affected worse than the ringgit due to their geo-political involvement or being dovish outliers on rate hikes. But even that larger depreciation would not hurt those better-equipped nations as bad as a relatively smaller depreciation can hurt our country, given its structural economic weaknesses, shrinking industry and massive dependence on food imports.

However, to a large extent, the information about all the Fed rate hikes (completed and coming) has already been built into the prices a long time ago and now it is more of the fundamentals for every nation.

In Figure 2, notice how the ringgit weakened only moderately, even after two consecutive 75 basis points rate hikes by the Fed and even with sliding crude oil prices at the backdrop. However, also notice how the ringgit started to descend, like on steroids, when another Fed hike coincided with the first talks about #undibanjir.

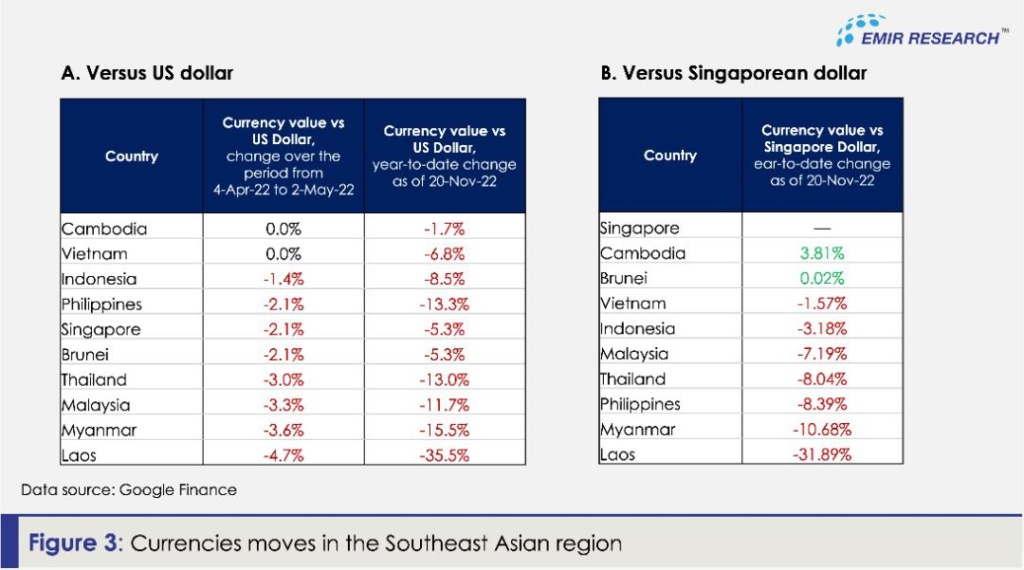

In Figure 2, notice that the first serious move for the ringgit happened during the Covid-related lockdowns in China, coinciding with the devaluation of the Yuan, climate-related damage to agro produce in various parts of the world, escalating fuel and fertiliser prices resulting in full-fledged food security crisis in many countries, including Malaysia. During that period, within the Southeast Asian region ringgit versus US Dollar performed better only in comparison with Myanmar and Laos (Figure 3.A), indirectly pointing to the fact, among other things, that Malaysia’s inflation rate, at that time, was worse than in most of the region.

We cannot continue to brush off the problem of significant ringgit depreciation with the book-style statements that it will boost our trade and growth — a very uncertain statement based on data and science.

Accumulated evidence (very pregnant literature review can be found here) in the form of conceptual discussions, mathematical modelling and empirical findings from 1940 to 2021 suggests that the positive outcome of currency depreciation is more certain only for the countries with complex industries, robust production of goods and services for both local consumption and exportation (therefore with potential to easy substitute imports, especially inelastic such as food) who heavily endeavour to nurture and preserve local talents, improve local technology, enhance infrastructural facilities to prop up GDP and employment (not underemployment) which goes back to the structural reforms.

Otherwise, only a very meagre positive effect can be expected exclusive to profit earners (and not all local) rather than wage earners widening the income gap.

We need to recognise the problem and restore confidence in the ringgit credibly.

The long-term measures require structural reforms in economics and governance. In the medium term, all mega projects that are not a priority should immediately cease or postpone. In the short term, policymakers must at least voice out a credible strategy (not handouts, subsidiaries and other hole plugs) for moving the nation forward supported by clearly set Input-Output-Outcome-Impact (IOOI) links (based on data and science) and metrics.

The IOOI framework is logical and robust reasoning (solely based on science and data) of the entire causal path from inputs (scarce resources / capitals) to outputs (tangible and intangible manifestation of intervention activities) to outcomes (real-world benefits / changed lives) and finally to impacts (higher-level intergenerational goals, if we speak in the context of a nation).

Rate hikes are not a solution. On the contrary, it will only accentuate the problem of an already weak economy. This is why even stronger economies such as Japan, for example, stubbornly maintain their dovish position even as the Japanese yen continues its descent understanding the fragility of post-pandemic economic recovery.

Attractive rates are no longer enough to entice capital or reverse or at least slowdown ringgit outflows. The investors are taking money out of Malaysia due to a huge trust deficit in the current governance system.

It is true that the money now is seeking a “safe haven” which is not necessary the US, especially when new Bloomberg Economics model projections suggest that the US recession is effectively certain within the next 12 months.

In the Southeast Asia region, Singapore appears to be the centre of attraction for the capital (Figure 3.B).

As far as the ringgit is concerned, the investors want to see when the Malaysian policymakers are finally going to get serious about the matters of strong governance, radical transparency, widespread digitalisation (starting from the public services), innovation, creation of high paid jobs for many, empowering small farmers for flourishing food security, nurturing and preserving talents etc. Those are the issues which, as we now discover more and more, were never addressed during the Barisan Nasional (BN) era and, likely, on purpose because solving those problems will equalise and empower all the Malaysians making the nation factionless and united (see “Becoming the citadel of corruption, paving the way to a failed state” for insightful details).

The investors can discern the extractive economic and political institutions. They can read between the lines of the feudal and corporate elite goodies budget. They can also calculate immediately how #undibanjir can translate into low voter turnout, which has historically benefitted the BN government.

It is cruel to hear from our policymakers and some analysts how they are “not too worried” or “not terribly worried” about the ringgit flipping a little bit more.

The sentiment is quite different on the ground for those B60 whose major part of disposable income goes to food. The plummeting ringgit is not making it more affordable, given our food security insecurity.

So for the delusional unbridled politicians — continue to stay in your oblivion state. For the rest — brace yourself for seeing simply ballooning imported food bills on a ringgit sliding further and shrinking disposable income, especially if GE15 goes wrong.

Dr Rais Hussin is the CEO of EMIR Research, an independent think tank focused on strategic policy recommendations based on rigorous research.