Published in MalayMail & AstroAwani, image by AstroAwani.

The Malaysian 5G rollout saga that, despite all the deadlines, is taking us already into May 2023 demonstrates what a daunting task it is for the current administration to rescue Malaysia from the tenacious grip of the global and local colonialists of the modern days zealously working in perfect tandem across all the verticals (officials, business elites and diplomacy). Once again, this truly highlights the deplorable state of our national sovereignty resulting from decades of corruption.

It is particularly despicable how business elites dare to dictate, in an ultimatum-like fashion, to the current administration what should be the way forward for the nation—and this is despite ministerial warning against such lobbying.

In its research-driven articles on the matter (supported by verifiable and publicly available data as well as by science and economics), EMIR Research has already exposed countless times how the proponents of the Single Wholesale Network (SWN) rollout model for 5G in Malaysia mislead the public through shameless overstretching, misplacing, misrepresenting and cherry-picking of facts and arguments.

DNB proponents appear to desperately run out of an argument, as the Malaysian public, including the current administration, already knows that the purported “low cost” of 5G infrastructure under DNB and, therefore, the eventual low price to the consumer is severely misrepresented (see, e.g., “Malaysian 5G Rollout: Camouflaged Costing Acrobatics” for details), “solving digital divide” through this rollout model is a complete whitewash (e.g., “Malaysian 5G Rollout: Digital Divide Whitewash”), SWN is a complete proven failure elsewhere (e.g. “Malaysian 5G Rollout — Topsy Turvy Innovation”), and there is a quick credible way forward without causing any delays to the 5G rollout or other complications (e.g., “Malaysian 5G Rollout: Credible Way Forward”).

Therefore, as of recent advertorial themes, the argument comes down to a new low, which is blaming the Malaysian Mobile Network Operators (MNOs) for “poor track record in rolling out 4G”—over-charging Malaysian consumers, profiteering, underinvesting and therefore, providing substandard quality of the network.

However, in this zealous attempt to defend DNB by hook or crook, DNB proponents simply bend the truth, which is seen even in the global, publicly available, and verifiable data reports.

Examining global data points, it makes sense to look no further than 2019, the sunrise year for 5G, to ensure fair comparison among the countries.

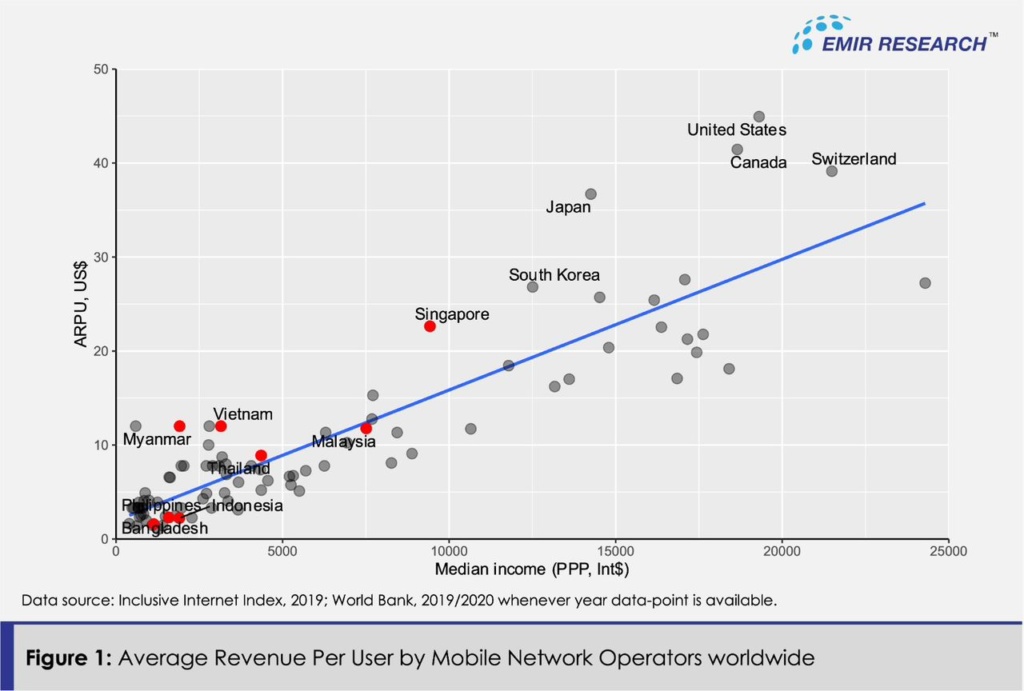

For example, EMIR Research already highlighted that by properly unpacking global data, we can see that Average Revenue Per User (ARPU) for Malaysian MNOs is at par with their regional peers (Figure 1)—the trend line in Figure 1 is a graphical representation of which markets have balanced ARPU and median income.

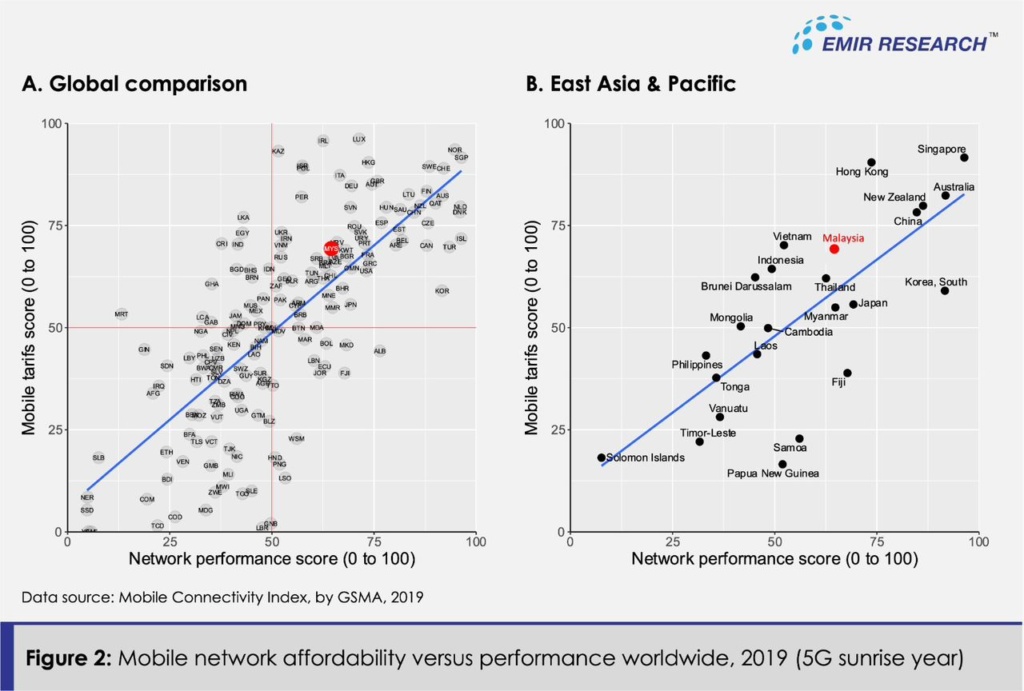

Based on another globally regarded index, the Mobile Connectivity Index by GSM Association, we again see no evidence that Malaysian MNOs were making excessive profits at the expense of poor quality of service (Figure 2). Figure 2 demonstrates a solid positive relationship between mobile network performance (a measure consisting of mobile download speeds, mobile upload speeds and latencies) and mobile tariff affordability worldwide (a measure composed of costs for the various mobile broadband data plans—entry basket 100MB, medium basket 500MB, high basket 1GB, premium basket 5GB). Note that both measures in Figure 2 are scored 0 to 100, with higher scores indicating better performance.

Consistently, as of 2019 (just before the DNB’s saga), Malaysia was not only ahead of its most regional peers (Figure 2B) but the majority of other middle-income nations in terms of quality and affordability (Figure 2A).

Furthermore, this is congruent with the data collected by Worldwide Broadband Speed League for the mobile price calculated as an average price of 1GB in US$ (Figure 3), where it is seen that Malaysian mobile internet remained much more affordable compared with many Asian peers.

All of the above is provided that Malaysian MNOs support one of the world’s highest average monthly mobile data usage per mobile broadband subscription. According to various reports (e.g. by Ericsson, Statista), in 2019, the average monthly mobile data usage per mobile broadband subscription in Malaysia was 13–15 gigabytes (GB) which is significantly higher than in many developed countries in that same year (e.g. see OECD stats). And according to the same sources, Malaysia’s average monthly mobile data usage per mobile broadband subscription has jumped twice, to 26 GB/month, in 2021.

This rapid growth is probably because, in Malaysia, over 60 mobile broadband packages are available to meet the needs of various income groups, including the B40 community.

Reportedly, a minimum of 30% of customers in Malaysia make use of plans that offer unlimited speed-capped plans—figures not seen for many of our regional and international counterparts.

Major mobile network operators in Malaysia, such as CelcomDigi, Maxis, UMobile, Telecom Malaysia, and YTL, offer affordable prepaid mobile packages, like the Pakej Perpaduan Prabayar Internet Mudah Alih, to assist low-income communities in dealing with the rising cost of living.

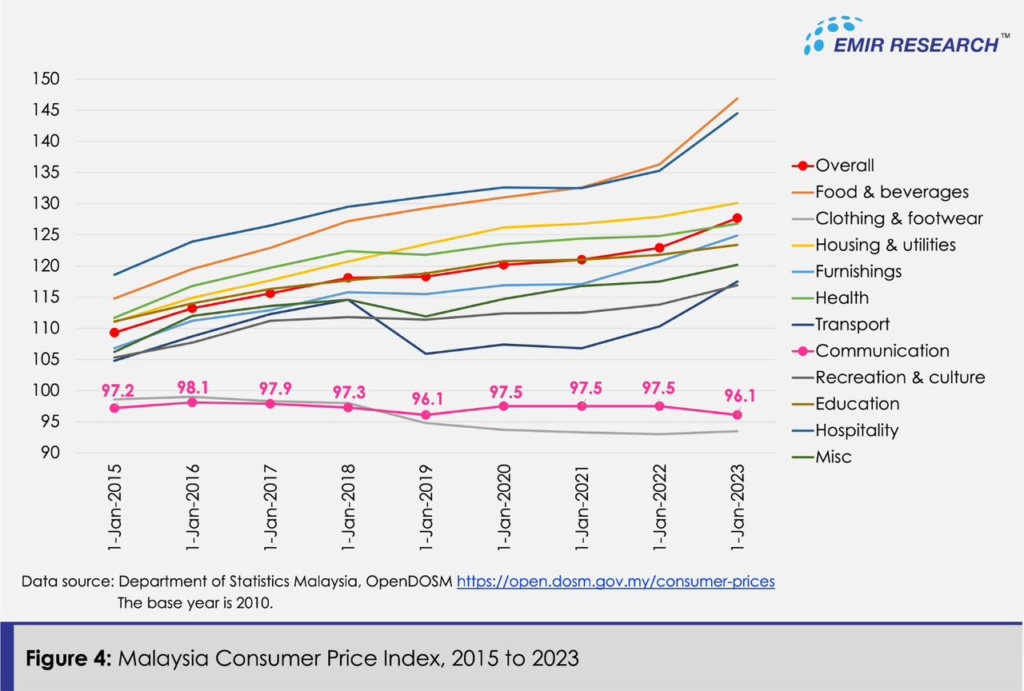

Fair enough, thanks to the efforts made by the MNOs, Malaysia’s communication sector has been one of the few industries that have not contributed to inflation in the past nine years, as shown in Figure 4.

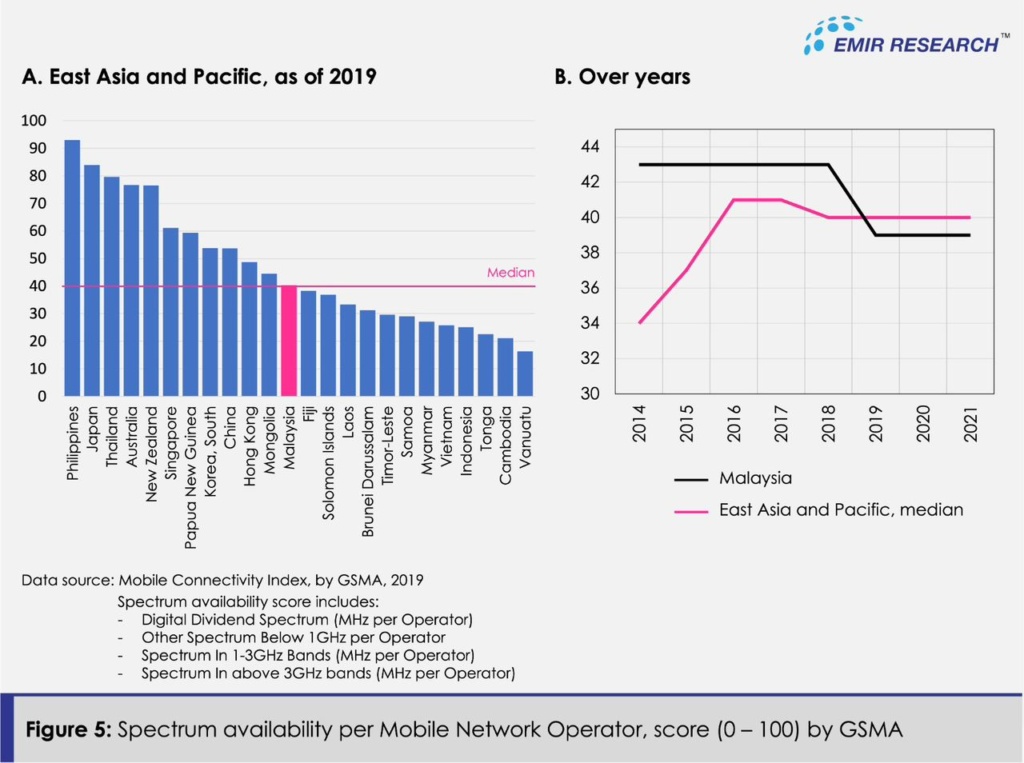

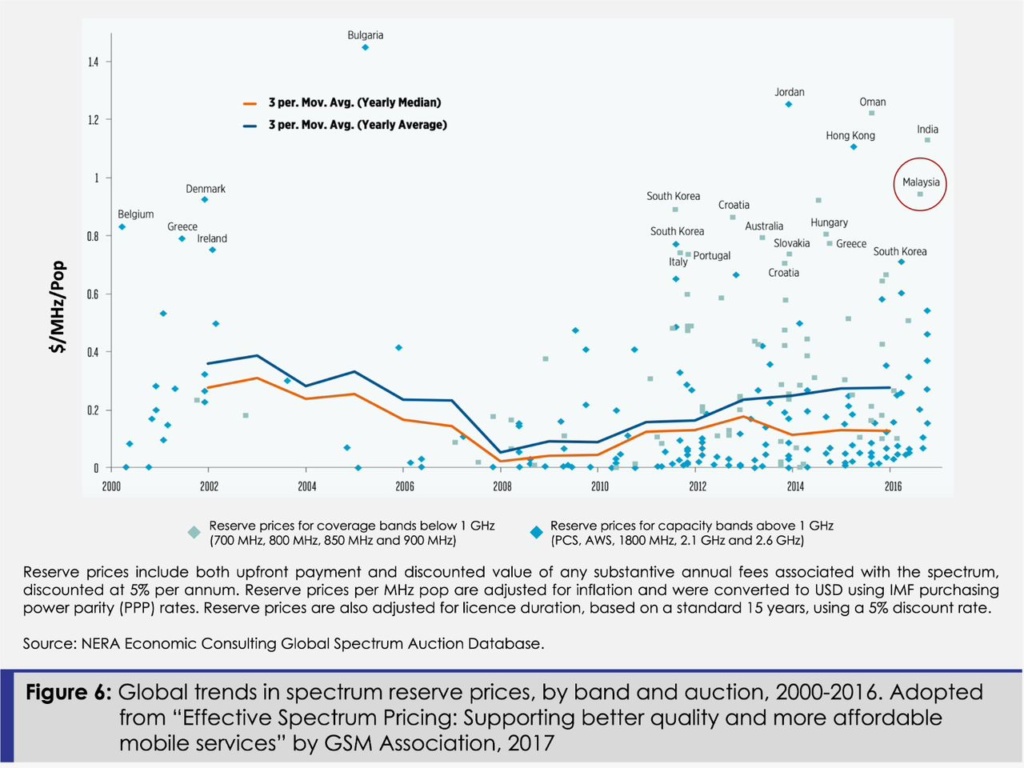

And all of the above is even though Malaysian MNOs have lower spectrum holding than their global and regional peers (Figure 5), which is also unduly highly-priced (Figure 6), according to the NERA’s (see the report by GSMA “Effective Spectrum Pricing: Supporting better quality and more affordable mobile services”).

An excellent question would be—why are DNB proponents not picking on these staggering spectrum statistics that severely disadvantage Malaysian consumers? The spectrum availability and spectrum cost to MNOs are crucial in delivering high-quality internet at affordable prices to end consumers, especially for the newer (more investment-demanding) generation technologies. Yet, as we can see from the global data, Malaysian MNOs have delivered an affordable quality network even within these severe constraints. But we could have done much better should our spectrum policies reflect more common sense.

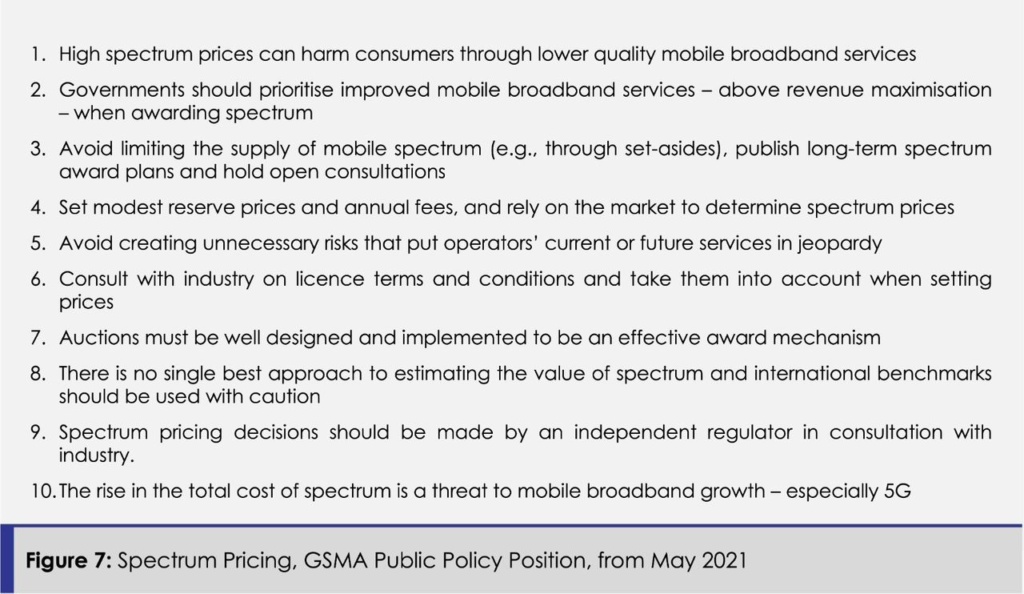

GSMA was very clear in its negative position on spectrum over-pricing and withholding (see “Spectrum Pricing, GSMA Public Policy Position” from May 2021) (Figure 7).

If we sift through the best principles in Figure 7, Malaysia has violated all with its DNB move.

EMIR Research has already explained in detail how DNB’s “innovative model” is nothing but a negative innovation example of extreme spectrum monetisation by the government and how damaging is the impact of such policies to the industry (refer to “Malaysian 5G Rollout: Spectrum Economics & Deadweight Loss”).

So given all the facts based on data, science and economics, are we still to pursue the Single Wholesale Network (SWN) Model? Are we still to ignore completely the global wisdom that took to the competitive Multiple Wholesale Network (MWN) model pathway? Are we to continue to be held at ransom by the FEW “axis of evil” who are to benefit from it rather than the MANY? Can this country continue to bleed unabated so very FEW can drown in wealth? Cannot we, for once, take a bold step in correcting the erroneous path and do the right thing? Or is it asking for too much?

Dr Rais Hussin is the president and chief executive officer of EMIR Research, a think tank focused on strategic policy recommendations based on rigorous research.