Published by AstroAwani & BusinessToday, image by AstroAwani.

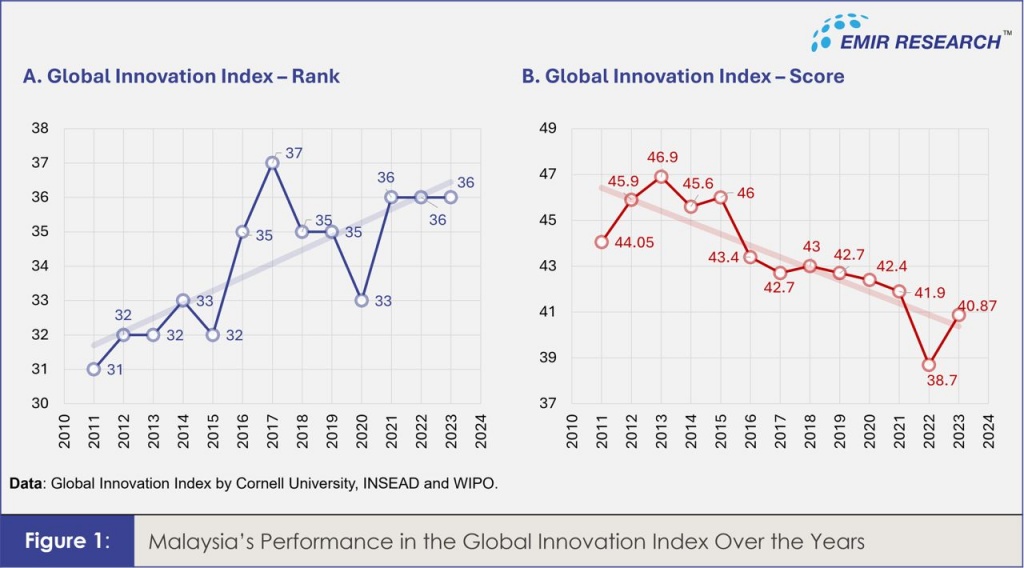

Malaysia’s Global Innovation Index (GII) rank has generally worsened over the years. Ranks, as relative positions to different comparison groups, can be misleading and falsely comforting at times. However, the GII score as an absolute measure reveals a much clearer and truly alarming picture (Figure 1B), showing how Malaysia’s innovation ecosystem has been in a steady and steep decline for more than a decade.

Establishing the Malaysia Innovation Index (MII) undoubtedly can help in closing this gap, as only what is measured gets attention, and what is tracked is managed! However, it will certainly require serious innovation soul-searching by policymakers.

Although the MII cannot and should not replace the GII at the international level—since “you cannot mark your own papers” and the outside world will not accept the MII as an independent or impartial evaluation of the nation’s innovation—it can still serve as an important internal barometer for innovation on the national and interstate level.

Additionally, as the MII must involve credible and timely data gathering from federal to district levels, some of these data points might serve as input for the GII and other global indices, ensuring an accurate representation of Malaysia’s position. For instance, Singapore (consistently ranked among the top 10 in GII throughout the years) takes global indexes very seriously and has a competent team dedicated to providing accurate data in a timely manner.

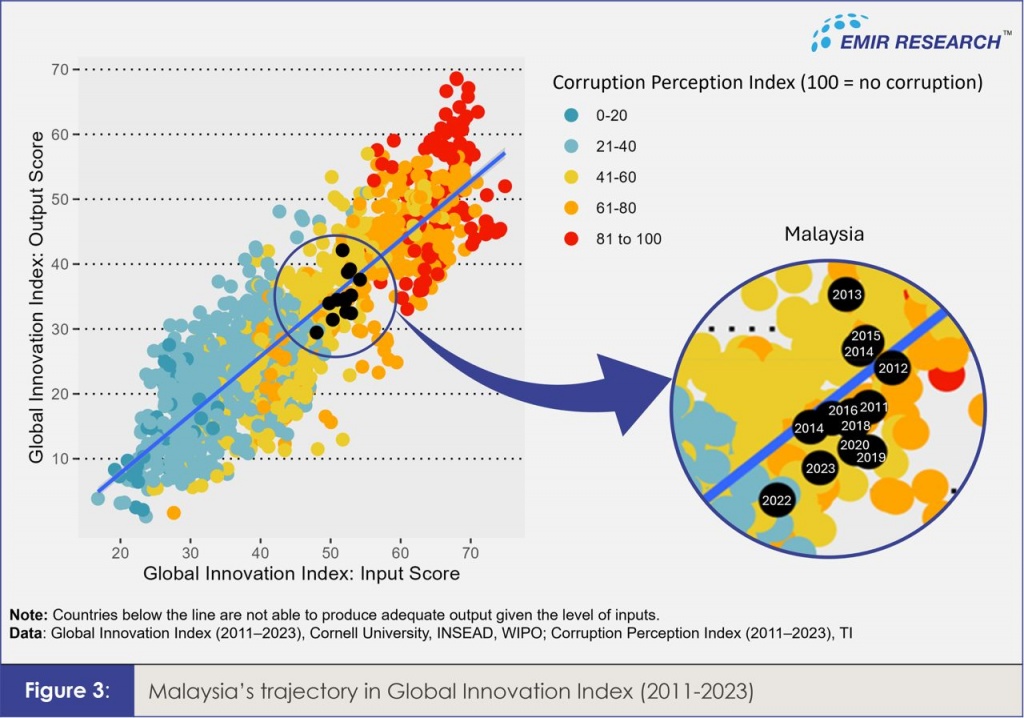

In devising the MII, MOSTI can take inspiration from the GII. The GII is not only an index that measures innovation but also a well-constructed global index with a methodology that ensures a balanced and comprehensive assessment of innovation capabilities and results across different countries. Notably, the GII is divided into sub-indices: Innovation Input (resources spent on and committed to innovation) and Innovation Output (tangible outcomes and impacts for the nation).

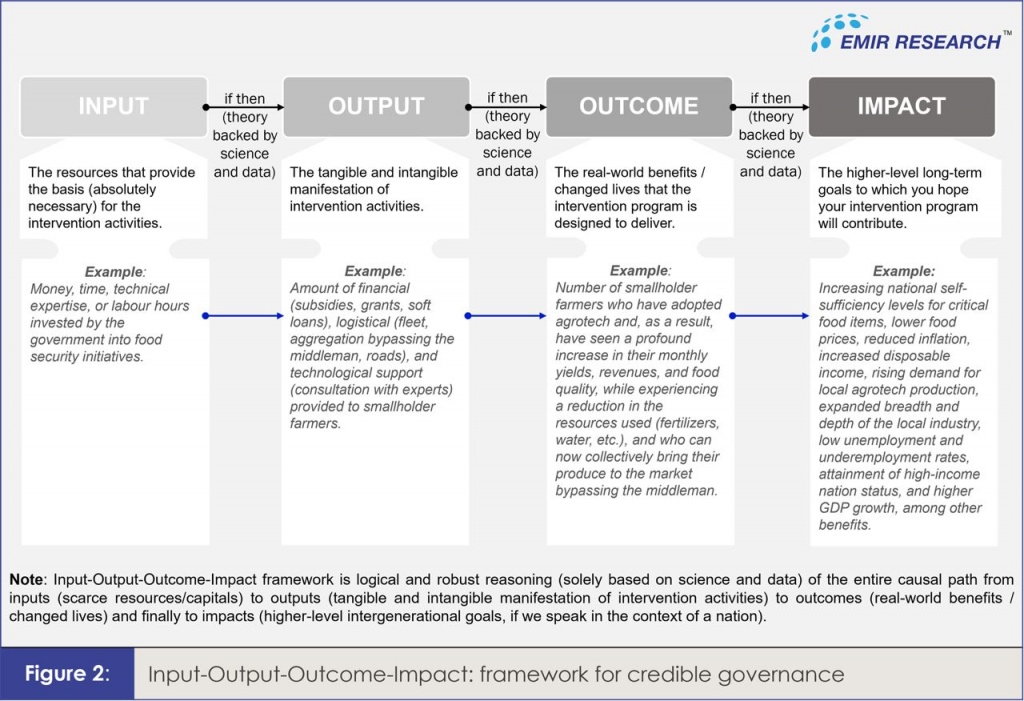

Such a division perfectly aligns with the key framework for credible policymaking (including that in the sphere of innovation)—the Input-Output-Outcome-Impact model/IOOI (this is where the Cornell University, INSEAD and WIPO were coming from while devising GII). Institutionalising this IOOI framework across all government and government-linked entities is paramount to transforming Malaysia from a third- to first-world country (refer to published article “Transforming Malaysia from third- to first-world country”).

Obviously, in devising their GII, Cornell University, INSEAD, and WIPO used the Input-Output-Outcome-Impact (IOOI) model (Figure 2), the key framework for credible national policymaking.

EMIR Research has long emphasised that institutionalising the IOOI framework across all government and government-linked entities is paramount to transforming Malaysia from a third- to a first-world country (refer to “Transforming Malaysia from third- to first-world country”).

Countries like the Netherlands, Finland, and Norway widely practice the IOOI methodology in their public administration to optimise public funds for genuine nation-building. Consequently, these countries top the GII and other global indices. The New Zealand government’s introduction of the “well-being budget” in 2019 is another example of policy innovation inspired by the IOOI paradigm. This framework encompasses 60 indicators of quality of life beyond purely economic, serving as concrete measures of outcome and impact.

IOOI framework is logical and robust reasoning (solely based on science and data) of the entire casual path from inputs (scarce resources/capitals) to outputs (tangible and intangible manifestation of intervention activities) to outcomes (real-world benefits/changed lives) and finally to impacts (higher-level intergenerational goals, if we speak in the context of a nation).

In other words, policymakers must convince us, based on science and data, why they expect outcomes and impacts given the inputs and outputs they commit.

For example, if the IOOI framework had been implemented, we would never have Digital Nasional Berhad with its Single Wholesale Network (SWN) model, which, speaking of innovation, is, if anything, a perfect example of “negative innovation.” This is because global empirical data and economic sense clearly show that implementing such a model nationwide guarantees failure.

The IOOI framework, by illustrating empirical links (as shown in Figure 2), makes it easier for policymakers to determine which ministries should collaborate productively. Additionally, since it is data-driven, the IOOI naturally ensures national policy continuity. My visit to Sweden (consistently ranked among the top 3 in GII throughout the years) revealed the following:

- Extreme inter-ministry, intra-ministry, inter-agency, and intra-agency collaboration with no barriers and no “territorial excellence” issues.

- A very clear, agreed, and shared mission.

- Strict adherence to the IOOI model, focusing on outcomes and impacts for the MANY at all times.

- A very clear structure, construct, and waypoints in the innovation journey.

- An innovation bill that survives or overrides any political or leadership changes.

Therefore, there is a high hope that IOOI will explicitly underpin the forthcoming MII as well as a new paradigm for the policymaking approach (to integrate MII into national policymaking naturally) to ensure that we begin to rip the fruits of innovation nationwide.

Otherwise, as GII illustrates, not only has there been no increase in key inputs, but these inputs have not translated into credible national outcomes and impacts over the years (Figure 3).

Malaysia’s low scores and rankings in knowledge, technology, and creative outputs indicate a weak innovation ecosystem and impaired commercialisation of innovation.

One important change we need to make is to extend the set of key performance indicators (KPIs) beyond the number of peer-reviewed publications by government research agencies and higher education institutions to include the scale-up and commercialisation stages (must also be included in MII). This will naturally promote productive outreach activities and collaboration with private entities!

Where should these collaborative activities be focused? Creating a good technology or product does not guarantee commercial success. Innovation may fail because the university’s breakthrough is not market-adapted, integrated into distribution channels, or communicated to customers. A university’s effective innovation requires competent marketing support, however, not just to promote existing developments but to create high-tech products that exactly meet market needs. This approach requires highly qualified staff with specialised marketing/economic education, which is not always available. Therefore, a third important party in collaboration between universities and the private sector is marketing companies.

Such an approach will also solve the problem of funding for the university’s innovative activities, relieving the government burden. In an innovative economy, higher education institutions act not only as centres of education, science, culture, and upbringing but also as market participants, selling the results of their scientific activities. This approach is followed by many highly innovative economies.

Therefore, we could consider using the average number of small innovative enterprises in universities or the universities’ share of income from the sale of intellectual property as important indicators in the upcoming MII.

However, Malaysia’s GII rankings and scores highlight other issues on the path to successful commercialisation.

One positive indicator under the market sophistication pillar is credit. In GII 2023, Malaysia scored 93.9 (up from 60.6 in 2022) for “finance for start-ups and scaleups,” ranking 2nd globally.

However, these financing capabilities risk being underutilised if Malaysia’s research talents are under-represented in businesses and if businesses show little interest in financing R&D. In GII 2023, Malaysia scored 34.0 (up from 32.9 in 2022) with a low 62nd ranking in the “knowledge worker” indicator under the Business Sophistication pillar, notably, with none of the sub-indicators categorised as our strengths, including low gross domestic expenditure on R&D (0.5% of GDP).

We know that this severe underrepresentation of research talents in industry in Malaysia is due to severe brain drain, which 20 years of empirical research attributes to factors like unsatisfactory salaries and perks, low job-skill match prospects, low promotion prospects, low prospects for professional growth and personal development, lack of stimulating and conducive work environment (refer to “Malaysian Brain Drain: Voices Echoing Through Research” for more details). These key issues need addressing. MOSTI should include these indicators in the upcoming MII, as, again, only what gets measured and tracked can be noticed and hopefully managed!

Relatedly, under the Market Sophistication pillar in GII 2023, Malaysia ranked 11th in market capitalisation (as a percentage of GDP) with a score of 117. This is influenced by the size of Malaysia’s GDP and does not indicate if the money promotes innovation.

However, Malaysia scored only 21.4% for gross capital formation (GCF; as a percentage of GDP), ranking 86th. Since GCF relates to the economy’s assets, this could indicate a lack of emphasis on building real infrastructure and the real economy, despite significant investment funding potential. This is not surprising in the absence of IOOI—when resources are not distributed optimally, we also fail to learn about resource distribution nationwide, including talent and innovation.

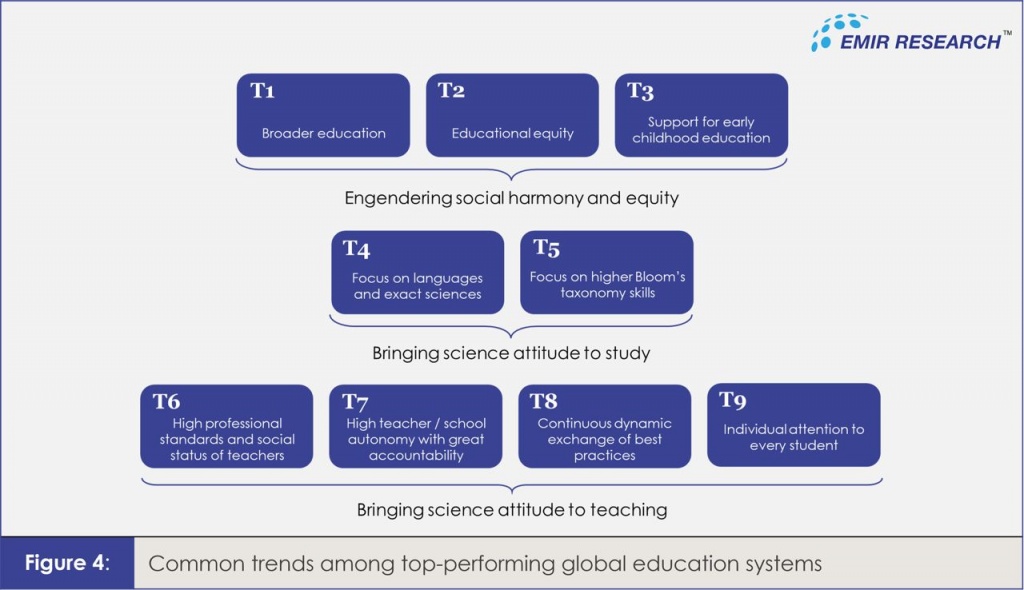

Another interesting phenomenon reported by the GII is Malaysia’s high rank of 11th in the “Tertiary education” indicator, particularly the “Graduates in science and engineering” (S&E; percentage) sub-indicator, where Malaysia ranked 1st in the world in GII 2023 (3rd in 2022, 5th in 2021).

It is hard to reconcile this trend with a previously reported trend of a much higher enrolment in arts and commerce compared to sciences in Malaysia’s higher education institutions. Additionally, how can we reconcile this with declining STEM enrolment in secondary schools, high dropout rates, and the overall low tertiary enrolment score (ranked 77th in GII 2023)? The percentage of graduates in S&E could be over-represented due to the lower number of graduates in other fields.

Another possible explanation for this paradox is that other nations are erasing the distinction between science, technology, and other fields, recognising how S&T permeate all areas and embracing more integrative educational approaches.

The issue of quality versus quantity is even more concerning. Low PISA scores in secondary schools indicate a risk of Malaysia producing low-quality students.

Singapore’s PISA scores in reading, maths, and science are 556.5, ranking 2nd globally, with a gross tertiary enrolment of 93.1%, ranking 9th. In contrast, Malaysia’s PISA score is 430.9, ranking 48th, with a gross tertiary enrolment of 41.4% (42.6% in GII 2022), ranking 77th (74th in GII 2022).

The Malaysian education system has been in crisis for a long time, and credible reform is overdue.

It is commendable that the government is seeking knowledge on specific changes needed to ensure our education system resumes its role as a key driver of an innovative economy. It is hoped these initiatives will align with key trends (Figure 4) observed among education-leading nations (refer to “Urgent Need to Reform Malaysian Education System” for details). These trends (T1 – T9) are also great candidate indicators for our upcoming MII.

After all, if we construct the MII properly and incorporate it into decision-making in an IOOI-driven manner, our improvements in MII will eventually be reflected in the GII and other global indices measuring national outcomes and impacts.

Dr Rais Hussin is the Founder of EMIR Research, a think tank focused on strategic policy recommendations based on rigorous research.