Published in Astro Awani, Malaysiakini, Focus Malaysia (part1, part 2), The Malaysian Reserve, MYsinchew, SinarDaily, Asia News Today, image by Focus Malaysia.

As tragic as the last two years of geopolitical and geoeconomics shockwaves are, they have become the long-needed litmus test to expose how far the country can go on pure “narratives” as a bad substitute for credible policies and logical crisis management.

With the recent developments in Malaysia’s food security, it is becoming unimaginable to speak earnestly that amidst all this — in many ways self-inflict and self-exacerbated disaster — Malaysia’s economy is “heading in the right direction”.

Especially when the whole world is facing similar challenges, it is very easy to shift responsibility and blame those external geopolitical and geoeconomics shockwaves, including the Asian region. Catastrophic events such as wars, pandemics, or natural disasters always help write off serious governing flaws. However, perhaps, not in the eyes of an average Malaysian anymore. No Mas!

The current Malaysian inflation is presented as “relatively low” and “under control”. It was up only 2.3% in April 2022 year-on-year, as reported by the Department of Statistics Malaysia (DOSM), with the food inflation at 4.1%. This is while, the price increases globally, are breaking records for at least a decade.

For example, in April 2022, prices for food increased 6.7% for United Kingdom (3rd on Global Food Security Index 2021) and 10.8 percent for United States (9th on Global Food Security Index)—the largest 12-month percentage increase since the period ending November 1980.

However, let’s remind where inflation comes from and how it can get out of control.

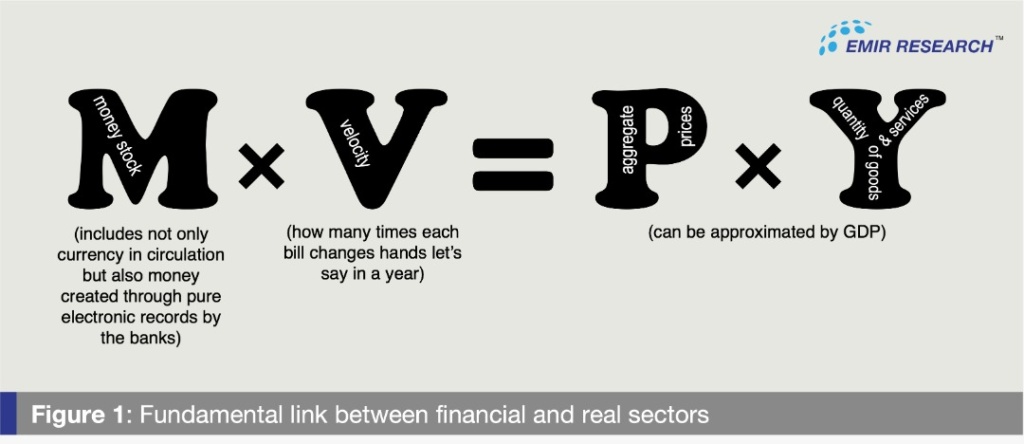

From the equation of exchange, the flow of money in the economy must equate to the flow of goods and services exchanged (Figure 1). This mathematical expression of the fundamental definition of money — money is only information about the value by which goods and services are being exchanged.

However, in our world, this fundamental law is violated. Money stock grows out of proportion (through credit creation as mere electronic entries). It creates immense upward pressure on both variables on the right-hand side of the equation (hence the inflation), leading to a periodic collapse of the market during which money stock (in the electronic form) gets destroyed.

From the above equation comes the apparent solution to the inflation problem — tightening the fiscal or monetary policy, which both, in current economic circumstances, would be a gross mistake, as Professor Jomo and his colleague elaboratively explain in “Finance Drives World to Stagflation”.

However, yet another way of looking at the inflation problem is glaring at us from the above equation (Figure 1). Since the real value of money is determined by the state of the country’s economy, there is no need even to expand money stock to trigger inflation — the economy needs just to slow down.

Furthermore, the equation also suggests there should be less money circulating in a weak economy. However, although sometimes necessary temporary measures, subsidies and government handouts also create the excess of unsecured money supply in the financial system, thus fueling inflation.

Therefore, inflation should be addressed by increasing aggregate economic productivity (industry’s breadth and depth) and not by adjusting the policy rates or constant subsidies!

This fundamental idea is incisively illustrated in the autopsy of the recent Sri Lanka collapse by the Governor of Central Bank Sri Lanka himself (see “Inflation is not the problem, but the solution”).

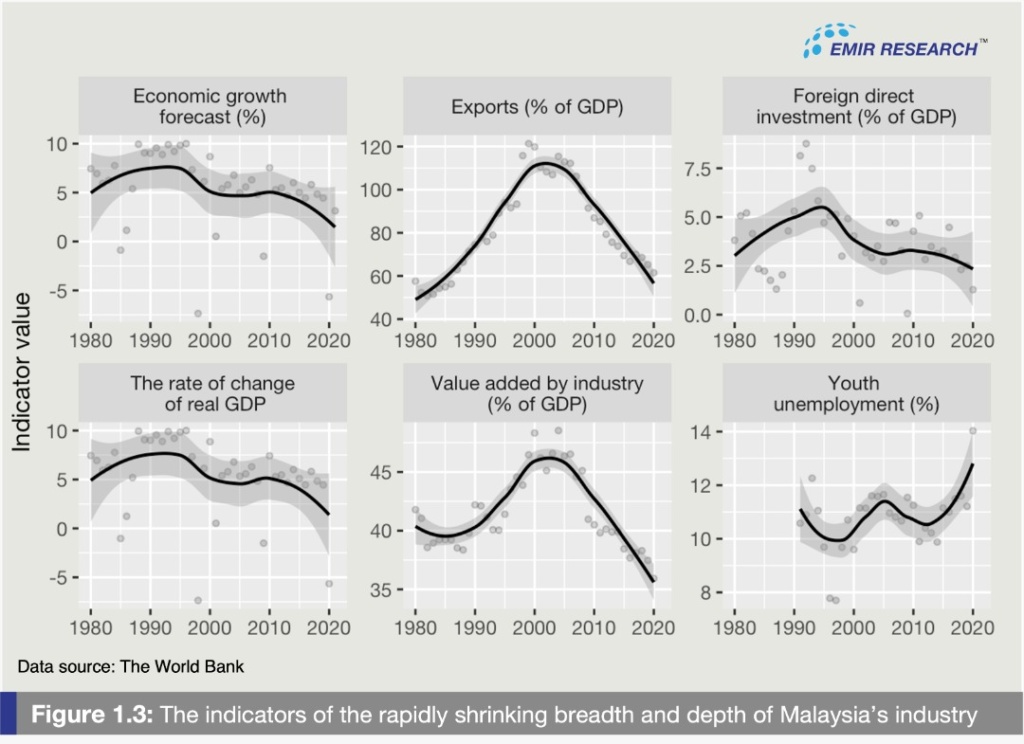

And here in Malaysia, we observe the carbon copy of the Sri Lanka scenario — the decades of addiction to subsidies and government handouts as bad substitutes for the credible governing and crisis preparedness policies. This led to a gradual loss of competitiveness, innovativeness and productivity, turning Malaysia into a nation of consumers versus producers, specifically in value-added products and services (Figure 2). And the ballooning national debt, even though not external, represents a considerable opportunity cost for the nation, leaving it with little space for productive use of the scarce revenues.

Given this systemic problem, it would be logical to see Malaysia hit by inflation the most with geggenpress.

This is because the onset of inflation triggers “natural selection” in the global real economic sector — the strong economies/businesses become weaker, and the weak ones leave the market leading to more shortages and supply-chain disruptions and further inflation.

Furthermore, for weak economies, the spillover effect of monetary tightening by advanced economies triggering capital outflows and pressure on the exchange rate is multiplied by general investors’ disinterest due to poor and shallow industry development.

The outflow of capital from the economy highly dependent on export, especially for essentials such as food, exacerbates inflation.

Worse else, the government addicted to deficit spending may see inflation as a handy tool to dilute the ballooning national debt.

Yet, Malaysia’s inflation is “miraculously” reported to be only 2.3% which raises serious questions to completely opaque methodology used to calculate it and also the ways it is managed.

Meanwhile, to credibly address the inflation problem, the government should put forward a two-prong strategy: 1) temporary emergency measures (short-term), 2) strategic course for strengthening the country’s economy (long-term).

For the temporary measures, EMIR Research would like to propose the following, in addition to currently rightfully implemented targeted subsidies and freezing approval permits for imports:

- Resist the urge to increase the overnight-policy rate. The credit rate that makes it difficult to work out the borrowed capital amidst sluggish economic conditions will take out more money from the realm of capital investment into the sphere of liquidity. Naturally, therefore, there will be even more inflation.

- However, should the government see the absolute necessity to increase the overnight policy rate, the important economic sectors must be shielded from such a drastic measure. It is critical to control credit expansion for consumption and speculation versus capital credit which can take the economy out of the drain in the current situation.

- Support small farm holders through grants, preferential and/or subsidized loans, reduced taxes, subsidized raw materials etc.— all the necessary conditions for the profitable operation of these enterprises in a crisis (see the earlier publication by EMIR Research “4IR enabled farmers: Solving national food security” and “Cultivating community farming culture into the current production ecosystem” for more detailed recommendations).

- Control the export, especially for the price-controlled items, as these can be used in speculative activities (buy cheap in Malaysia and export abroad). The risk of these activities is more so real in a corruption-ridden country.

At the same time the long-term measures must include:

- Focus full speed on import substitution as this is the only way to increase industry depth and breadth and dampen the inflation even with constantly expanding money stock. This will urgently require, among other things, serious education reform as a long-term measure and brain drain reversal as the short-term to medium-term measure.

- Specifically for the food industry, reinvigorate Universiti Putra (Pertanian) Malaysia as the flagman to drive modern farming innovation and make agriculture attractive and sexy for the youth again (majority of whom are currently unemployed and underemployed). 4IR solutions are known to nearly eliminate risk while increasing productivity in agri-business which would naturally push food prices down.

- Focus full speed on massive integration of 4IR solutions across the industries. The economies championing 4IR are known to observe such a phenomenon as tech deflation when 4IR solutions, through increased efficiency, exert intense downward pressure on prices.

- Revise the budgetary policy of the state to reduce the expenditures and increase the revenue side of the budget, which may include, among other measures, freezing the white elephant projects, reducing the bloated public sector, eliminating corruption etc. One powerful way to achieve all of these is through implementing the input-output-outcome-impact (IOOI) framework for budget and at every level of government administration (see the earlier publication by EMIR Research, “Recalibrating National Budget – Eradicating Leakages and Corruption” for detailed explanation).

The urgent anti-inflationary measures will only slow down the national currency depreciation rate but won’t lead the country out of the crisis. Therefore, a credible long-term solution requires a strategic reset. And until this is done, Malaysia is undoubtedly “heading in the right direction”, but only on the way to becoming another Sri Lanka, albeit a little later.

Dr Rais Hussin is President and CEO at EMIR Research, an independent think tank focused on strategic policy recommendations based on rigorous research.