Published in Astro Awani, Business Today, MYsinchew, Sinar Daily, The Star, Asia News Today & Malaysiakini, image by Astro Awani.

Despite the broadest publicity, all sort of advocacy and lobbying by various interested parties involved, the so-called single wholesale network (SWN) model proposition by Digital National Berhad (DNB), as it stands today, doesn’t hold water from the perspectives of nation-building, technical feasibility, financial and commercial viability as well as governance and integrity.

Therefore, this matter deserves urgent and closest attention, the highest level of scrutiny, radical transparency, and open and extensive public debate. Writing wide-page advertorial content that, in fact, raises even more critical questions and self-contradictions than providing definitive answers is one thing. However, it takes a whole new level of viability, economic sense, and feasibility to withstand open and live public debate with experts from across the industries.

In this series of articles (2 parts), EMIR Research invites the public and policymakers to critically relook into all the publicly available information surrounding DNB-led SWN proposal that transpires so far from those same critical angles—technical feasibility; financial and commercial viability; governance and integrity and of course widely-claimed intergenerational impact on the national wellbeing.

This part will focus on technical feasibility and financial viability, while the next part will cover governance and integrity and impact on the nation.

Technical constraints and considerations under the DNB-proposed model

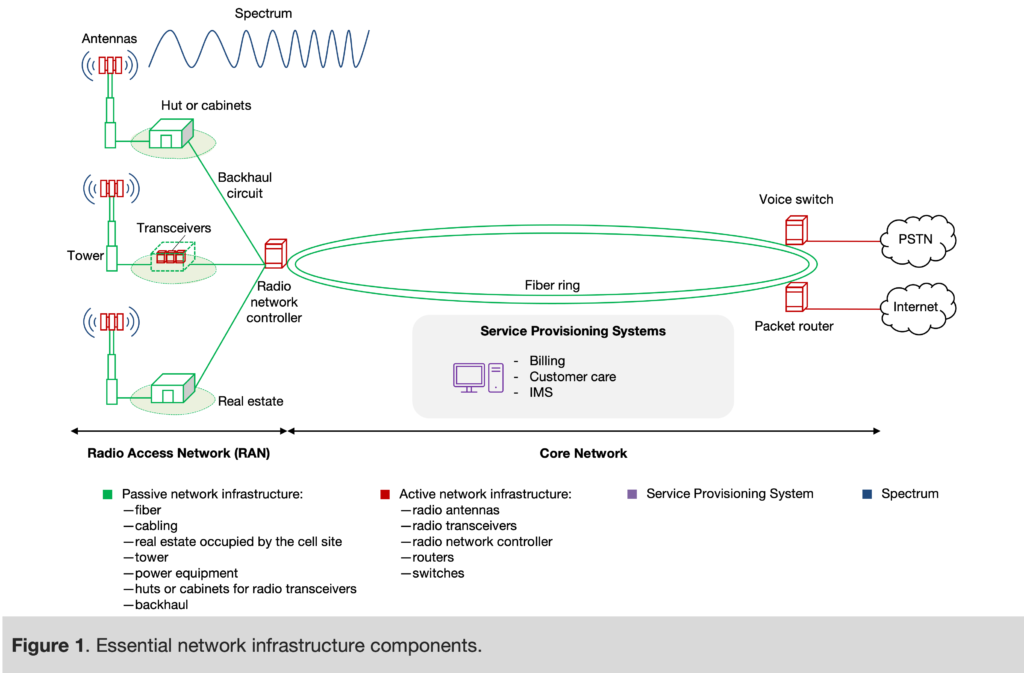

The following figures presenting essential network architecture components and sharing architecture models are instrumental for this discussion.

Although conceptually appealing, network asset-sharing is not always economically efficient or productive or beneficial to the end customers and rather a complicated matter that requires systems thinking analysis (for detailed review and analysis, refer to Clarke, 2014).

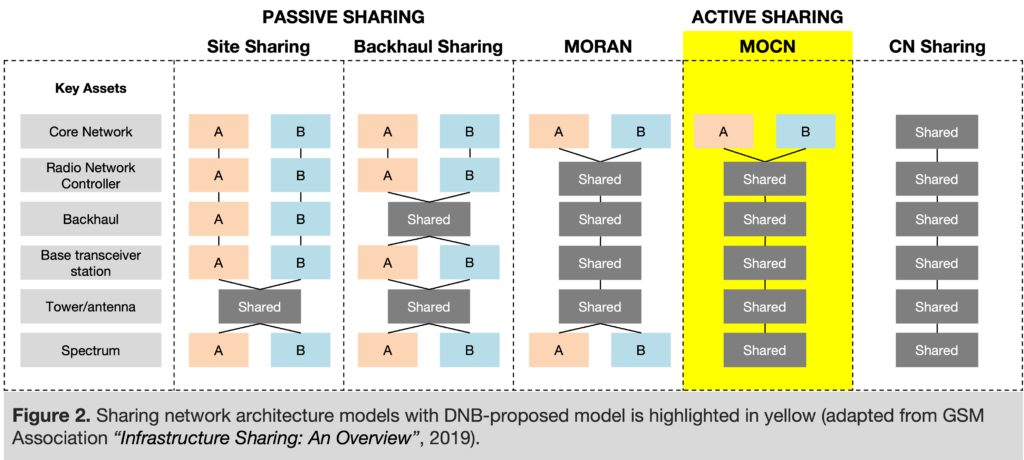

Based on publicly available information, DNB proposes Multi-Operator Core Networks (MOCN) model (Figure 2)—sharing active and passive Radio Access Network (RAN) as well as spectrum.

Technically, it is quite easy to share the passive infrastructure of RAN as it is very generic among the Mobile Network Operators (MNOs) and different mobile wireless technologies (see Figure 1). Also, economically, it is the most appealing as passive RAN constitutes the highest cost to MNOs. Therefore, it offers the greatest opportunity for deriving benefits without serious efficiency diminution in other aspects of network operation.

As for sharing of active RAN, it is possible only if the radio technology employed by the MNOs is similar—that is what DNB proposes to be built by Ericsson.

In contrast, spectrum sharing can be the most challenging, especially between like users, as it is in the case of MNOs.

Between like uses, spectrum sharing is possible by either geographic or temporal or frequency separation. However, the geographic and temporal separation is not possible in the case of the existing Malaysia MNOs landscape. Furthermore, now DNB proposes to get away with the frequency separation (by frequency band) to achieve claimed greater “spectrum efficiency”.

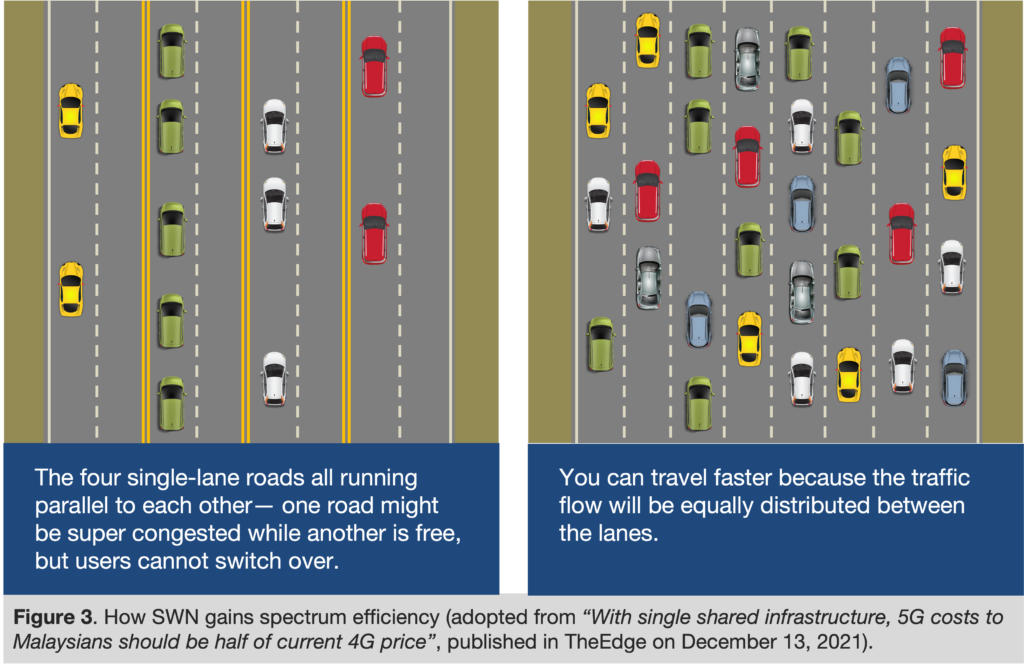

The DNB proponents explain this “spectrum efficiency” with a rather simplistic highway example (Figure 3).

However, in reality, spectrum sharing among like uses in the same geographic area and with similar time usage patterns is still possible but can become quickly economically inefficient due to extra RAN costs.

Therefore, this must be tested and confirmed to convince MNOs that the resulting quality for their operation (and for the end consumers) is not interrupted while significant cost savings are produced. As such, delivering “spectrum efficiency” can implicate the number of antennas, the distance between antennas on a tower, which would impact tower size, or even the necessity to deploy separate transceivers and, therefore, significantly escalate the cost of RANs and, in effect, become the exact duplication which DNB claims to overcome.

Furthermore, unlike passive RAN sharing, active RAN and spectrum sharing can have an undesirable impact on competition among the MNOs, which DNB is trying to avoid in the first place.

It is unlikely that MNOs would agree to share active RAN if there is no way to accommodate multiple frequency bands. This is because the active RAN equipment and spectrum bands are the critical assets for maintaining the long-term competitive advantage by MNOs in terms of quality or price, or both. While DNB-proposed MOCN model makes competition possible only on service-provisioning characteristics such as price plans, usage quota, customer service etc.—attributes that competitors can copy quickly and easily. Note that at the same time, under the MOCN model, MNOs can no longer guarantee the quality of network connection itself and related customer service because they now have to rely on DNB for technical maintenance of the active RAN infrastructure.

And here, with the above, we come to the crux of the whole venture—bridging the digital divide. If sharing and expansion of only passive RAN infrastructure, which is exceptionally scarce in our rural areas and has no added-value for MNOs, will undoubtedly motivate MNOs to come faster to the rural areas with their offerings, be it 4G or 5G, DNB-proposed MOCN model will have the precise opposite effect as being competitively malign.

In other words, if Malaysia needs a monopoly to solve its internet access problem on a nationwide scale, then it should be a neutral entity controlled by the government and tasked to build, operate and maintain passive RAN infrastructure with open access to all licensees. This entity can initially focus on new areas but, if need be, acquire the existing infrastructure on a willing buyer/willing seller basis. This was the proposition by Dr Mohamed Awang Lah, whom we can rightfully call “father of Malaysian internet” (see the article “A monopoly to open up competition” from 26 November, 2019).

It is worth emphasizing that this arrangement, where the government addresses inefficiencies in passive (non-value-adding) infrastructure (which are generally generic across MNOs) will naturally address the problem of national rollout contingency by mitigating single-point failures and delays.

Financial and commercial viability

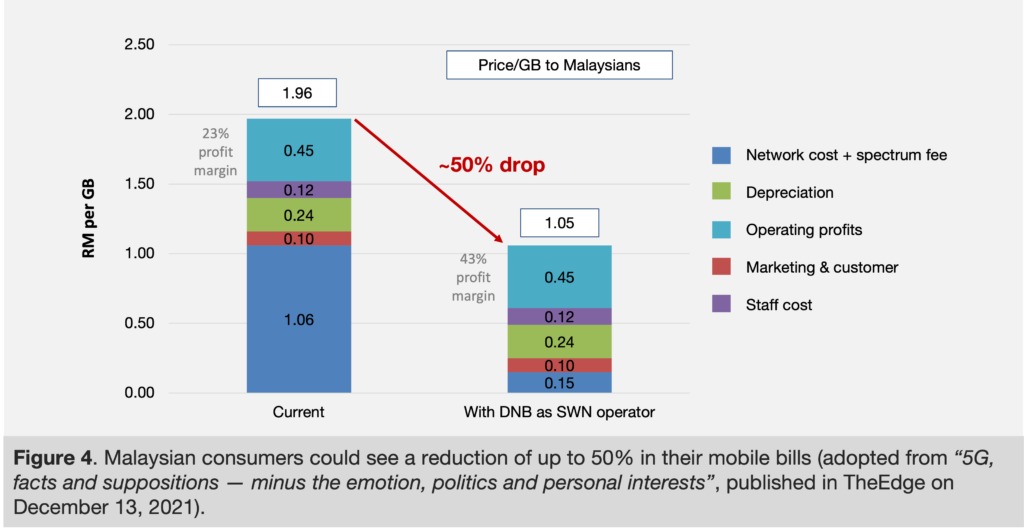

The MOCN model proponents claim that it will enable MNOs to provide lower prices (see Figure 4). However, the justification appears to be somewhat misplaced. It would make more sense to discuss the issue in terms of operating leverage and breakeven analysis—important costs dynamics.

Under the current (non-MOCN) model, the MNOs business model has high operating leverage. In other words, the cost structure is such that high upfront fixed cost comes from laying down the network infrastructure—passive and active—and spectrum licensing.

Nevertheless, these fixed costs can be quickly overcome (achieve breakeven) given the large subscription base and traffic volume. After the breakeven, due to low variable costs, nearly every ringgit goes into operating profit. Note that the sales volume is almost certain and even constantly growing due to the recent transition to the low-touch economy and 4IR, making this leveraged model quite a lucrative business.

However, under the proposed MOCN model for the 5G rollout, the MNOs would not have fixed costs in the form of investment in passive and active infrastructure. Instead, they would now have a new element (spectrum fee) to their variable costs, which would quickly eat into their operating profit margin given high sales volume. So now we can see how the above Figure 4 can be misleading.

Something that quickly eats into operating profit margin and deprives you of operating leverage would certainly not encourage the MNOs to provide lower prices. In contrast, if DNB could reduce MNOs’ major fixed costs through owning only passive RAN infrastructure without cutting into MNOs’ variable costs, MNOs could overcome their fixed costs faster and have more room for a price reduction. Note that the same model would also not arrest competition based on quality among the MNOs, as discussed above.

Nevertheless, under the DNB-proposed MOCN model, DNB officials claim a new variable cost element, which now rightfully could be called spectrum “fee”, would be very low—“at least less than 20 sen per GB”. However, it is unclear how DNB can ascertain this low cost, given its own cost structure.

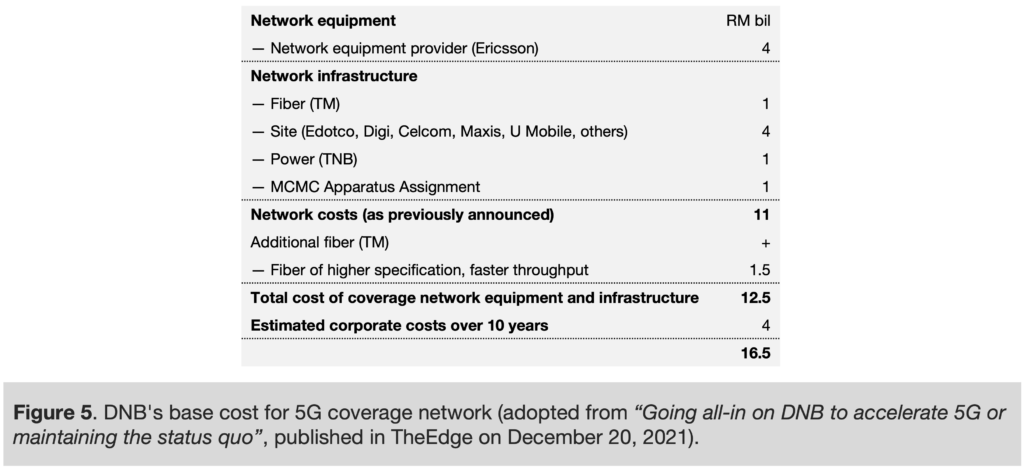

The DNB indicated that, since they do not own the passive RAN infrastructure themselves, it will lease it from the MNOs: “fiber” (most likely bandwidth through fiber) from Telekom Malaysia, site from Edotco, Digi, Celcom, Maxis, U Mobile and others—projected to amount to RM6.5 billion in total over ten years (Figure 5). Furthermore, Ericsson will build active RAN (another RM4 billion over ten years) (Figure 5).

On top of it, another RM4 billion as estimated corporate costs over ten years for an entity that nearly owns nothing, does nothing, except playing a role of a middleman of a kind, simply suggest itself for more scrutiny and breakdown.

Another interesting question suggests itself—would not MNOs be incentivized to set the lease cost for their passive infrastructure to offset as much as possible the spectrum fee? They probably would if they could as not all of them own a lot of passive infrastructure except the government-owned Telekom Malaysia (near monopoly), limitedly DiGi and Maxis, which brings another interesting perspective on the DNB proposed model.

Furthermore, the above-estimated costs (Figure 5) might be well underestimated given the specifics of 5G technology—possible hidden costs that were either not laid out transparently or not considered thoughtfully.

For example, as indicated above, the proposed 10,000 towers would be certainly not enough to provide projected coverage targets by DNB (90% coverage in populated areas by 2027).

As reported by MalaysianWireless, Malaysia had nearly 23,000 4G LTE towers in 2018, covering roughly 80% of the population. So, essentially, how would having less than half the number of sites as 4G towers provide even broader coverage when 5G travels about 6 times less the distance of 4G?

Practically, 4G wavelengths have a range of about 2 miles while 5G wavelengths only have a range of about 500 meters (about 6 times less than 4G). This means instead of one tower 5G requires 36 towers to cover the same radius as 4G.

Michelle Yan, the managing producer for Science Insider, provided examples where such towers or antennae could include every lamppost, traffic light etc. to ensure signal consistency since foliage, trees, and other physical barriers such as building structures (walls etc.) can block 5G signals (think of rural area again).

It is also unclear how having multiple local repeaters to access 5G signals (such as in people’s homes or in office buildings) will impact the cost to end-consumers.

Also, DNB’s proposition is to avoid cost duplication by MNOs in providing the passive and active infrastructure. However, they are not transparent about how such duplication factors into their costs to offer reliability, resilience, and redundancy—essential network architecture requirements.

Furthermore, as mentioned above, DNB doesn’t disclose how much cost can escalate due to the necessity of significant RAN infrastructure expansion to even make the “efficient spectrum” sharing possible.

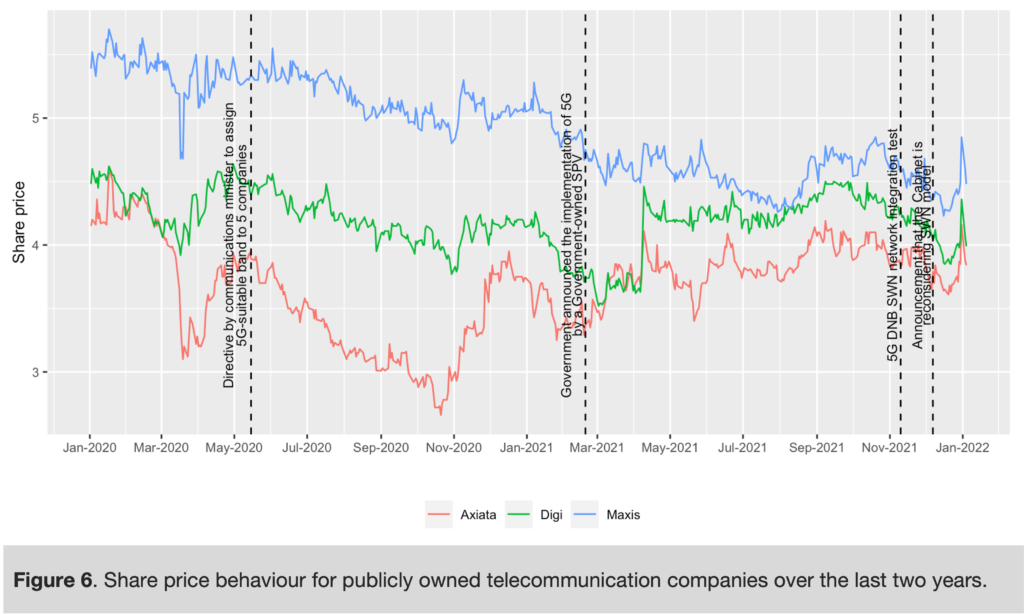

Coming back to operating leverage, removal of it from MNOs’ cost structure will moderate their share prices and have negative implications for dividends (currently received by government investment arms and general public perhaps for their retirement portfolios) or further innovation or both. Note how prices have ranged over the entire period of DNB-led SWN decision uncertainty (Figure 6).

Needless to mention the spillover effect that this whole deal will have on the foreign equity and direct investment in Malaysia, which we have been losing drastically over the last four years. For example, by the end-2021, Bursa Malaysia’s foreign shareholding already fell to 14.5%, the lowest on record, as reported by TheEdgeMarkets.com.

From an investor’s point of view, it is difficult to imagine one willing to contribute towards capital-intensive resources, especially critical to the infrastructure, in a country with highly inconsistent and irrational policies.

As we can see, the DNB proposition debate is a complex issue with numerous far-reaching implications for our economy and national future. Such fateful decision making cannot happen behind closed doors.

It requires full transparency of all relevant data (pertaining to ALL relevant costs and benefits) to verify and substantiate technical, economic and financial assumptions and necessitates systems thinking approaches brought to light in a live public debate. The outcome must be a synergistic win-win arrangement with respect to the cost-benefit for all stakeholders.

Rais Hussin, Margarita Peredaryenko and Ameen Kamal are part of the research team of EMIR Research, an independent think tank focused on strategic policy recommendations based on rigorous research.