Published in Business Today, Astro Awani, and theSundaily, image by Business Today.

Since Malaysia transitioned to the endemic phase on April 1, more Malaysians are resuming their usual routine of going out from home for work, leisure and travelling. More cars are travelling across the roads and highways – traffic jams can be seen everywhere in the Klang Valley, including during the weekends. More Malaysians are also flying out of the country or going on inter-state travel by plane.

Kuala Lumpur International Airport (KLIA) and Kota Kinabalu International Airport (KKIA) recorded more footfall than before (i.e., pre-endemic). Many Malaysians were relieved with the relaxation measures as they finally could release their pent-up tension – with the concomitant pent-up demand (for travelling) – after experiencing prolonged Covid-19 associated lockdowns for over two years.

However, with the continuous rise of food price inflation, are Malaysians in general able to enjoy the freedom of travelling around the world?

It might not be the case, especially among the eligible B40 and M40 contributors who had to withdraw their Employees’ Provident Fund (EPF)’s savings just to make ends meet.

During this April month, more than half of the eligible B40 and M40 members applied for the EPF’s special withdrawal facility – at 55% and 59%, respectively.

At the same time, 39% of T20 members and 29% of informal (self-employed or no formal employment) and inactive members also withdrew their savings from EPF.

Last Friday (April 22), the Department of Statistics Malaysia (DOSM) stated that the latest Consumer Price Index (CPI) has increased by 2.2% year-on-year (y-o-y) – from 122.9 in March 2021 to 125.6 in March 2022. It has surpassed the average inflation between January 2011 to March 2022, which stood at 1.9%.

Same as the preceding month (February 2022), a rise in food inflation is the main attribute in the increase of the CPI.

The 4% y-o-y increase in Food & Non-Alcoholic Beverages group was largely due to the rise in the sub-category of “food at home” by 4.3% between March 2021 to March 2022. As supply-side and supply chain issues persist, eggs, chicken and vegetables – commonly consumed food items among Malaysians – witnessed a price increase of 17.1%, 10.5% and 5.1%.

Spinach, lettuce and choy sum are among the vegetables that experienced a price rise the most – at 24.1%, 22.2% and 14.5%, respectively. The soaring vegetable price trend presented by the DOSM takes place amidst drastically reduced purchasing power among the B40 who have lost jobs or had their income halved by the economic impact of the pandemic.

Realistically, however, many may still be forced to reduce nutritious intake by purchasing cheaper food such as bread and instant noodles to counterbalance the effects associated with the rising cost of living.

On the other hand, the other sub-category, namely “food away from home”, increased from 3.6% in February 2022 to 4% in March 2022. Such a trend shows that more Malaysians are going out to eat frequently, among other social activities.

Rice with side dishes (6.6%), satay (6.6%) and murtabak (6.2%) are among the items that contributed to the increase in the index for “food away from home”.

The fact is increasingly expensive vegetables, poultry products and processed items force Malaysians nowadays to fork out more money purchasing the same portion of food.

As reported by The Star on April 23, titled “Inflationary consequences”, Saravanan, a minimum wage worker had to pay around RM10 extra to purchase 5kg of cooking oil nowadays.

Socio-Economic Research Centre (SERC) Executive Director Lee Heng Guie commented in the same report published by The Star that the price of 5kg of cooking oil increased by almost 41% – from RM20.98 in December 2019 to RM29.54 in February 2022. Over the same period, the price of 1kg of tomatoes also rose by 30.6% – from RM 5.19 to RM6.78.

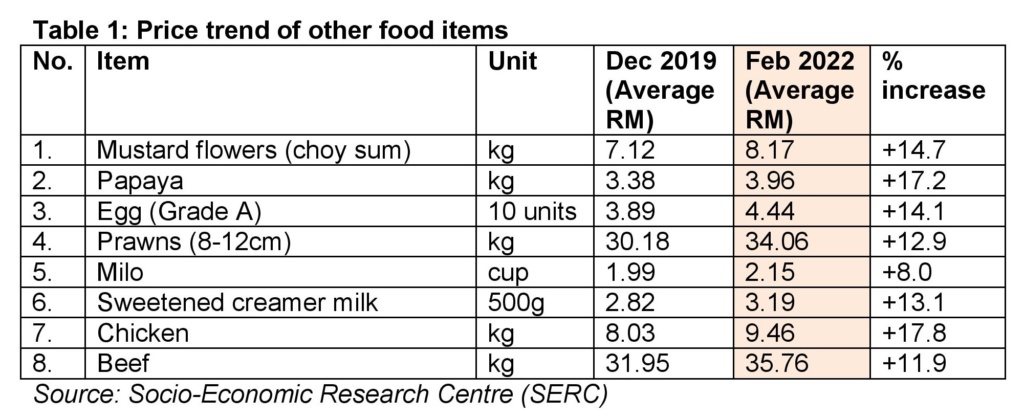

The other food items also experienced a price rise by at least 8%, as shown in Table 1.

Table 1: Price trend of other food items

Moreover, core inflation – which measures changes in the prices of all goods and services but excludes prices of volatile items of fresh food and goods controlled by the government – went up to 2% in March 2022.

Transport recorded the highest at 3.9%, followed by food & non-alcoholic beverages (3.5%), furnishings, household equipment & routine household maintenance (3.0%), restaurants & hotels (2.9%), miscellaneous goods & services (1.9%) and recreation services & culture (1.1%).

The rise in transport category is mainly due to the low base effect with the setting of the RON95 unleaded petrol ceiling price effective March 2021 at RM2.05. It was higher compared to the average price of RM1.96 per litre in February 2021.

With the flash floods hitting Klang Valley again on Monday (April 25), this would indirectly increase the associated costs among private vehicle owners. If the individual parks in the basement or drives around flood-prone areas, it would increase the risk of a car submerging in floodwaters. If the car has massive flood-caused damage and cannot be repaired, the individual has no choice but to purchase a new one for replacement.

Moreover, public transport users in the Klang Valley require to spend an additional RM20 on commuting when the Rapid KL unlimited travel pass has increased from RM30 to RM50 per month effective from January 1. If some places are not accessible to public transport, they still have to book e-hailing services such as Grab and AirAsia Ride to reach a particular destination within Klang Valley.

With lesser e-hailing drivers expected following the flash flood in Klang Valley yesterday during the current Ramadan period and coming Raya season, this will trigger further price hikes.

Usually, a one-way trip from Mid Valley to Bukit Damansara only takes 13 minutes of travel time and costs around RM13 around 10 pm. However, an 8km journey with almost one hour travel time due to the massive traffic jam on Friday night could now cost RM 28 – a whopping increase of 115%.

The continuous upward trend of the Singapore dollar (SGD) against the RM is expected to erode the purchasing power among Malaysians further. Bloomberg showed the exchange rate as of 1.52 pm yesterday (April 26) that SGD1 is equivalent to RM3.1710.

It is much higher than a decade ago (April 26, 2012), whereby SGD1 was only worth RM2.4583.

While Singapore recorded higher rates than Malaysia for CPI and core inflation – by 5.4% and 2.9% y-o-y, respectively in March 2022, most Singaporeans might not feel the direct hit arising from the rising cost of living as Malaysians. They still can afford to choose hawker food for daily consumption, which typically costs between SGD3 to SGD7 per meal.

If each Singaporean spends SGD21 in total (SGD7 multiplied by three meals) per day with a monthly salary of SGD3000, the monthly food expenditure (30-day basis) will be SGD630 – consisting of only 21% out of the monthly salary received in Singapore.

However, if each Malaysian spends a total of RM30 (RM10 multiplied by three meals) per day on average with a monthly salary of RM3000, the monthly food expenditure (30-day basis) will be RM900 – almost one-third (i.e., 30%) out of the monthly salary received in Malaysia.

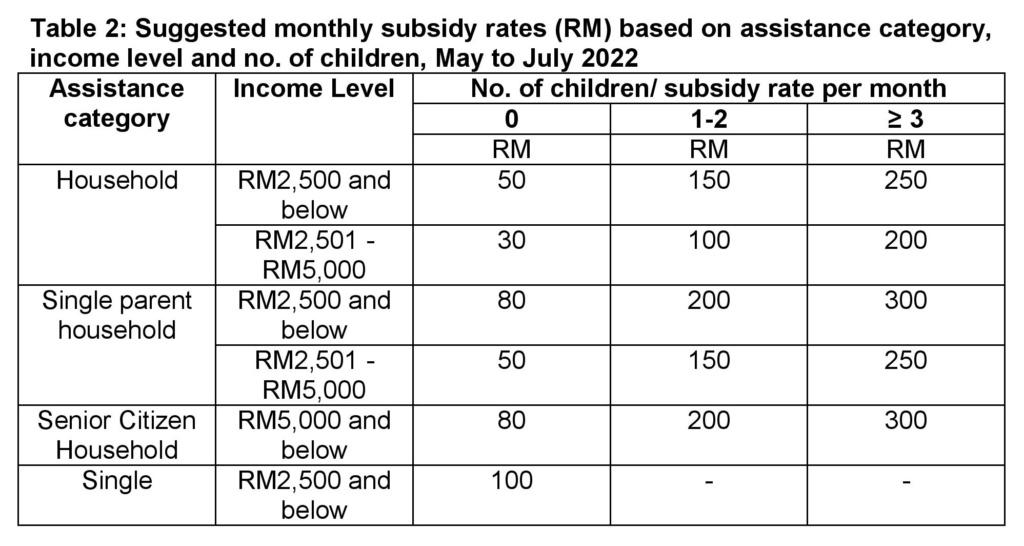

Hence, for Malaysians to cope with the rising price inflation, EMIR Research would like to recommend the current administration introduce three-month grocery, food and petrol subsidy vouchers for individuals and households in the lower M40 and the B40 income groups from May to July 2022, as presented in Table 2.

Table 2: Suggested monthly subsidy rates (RM) based on assistance category, income level and no. of children, May to July 2022

For example, a household earning less than RM2,500 with three or more children could receive RM750 (RM250 multiplied by three payments for each of the additional member of the household) per month (and capped at that amount) in total until July 2022. If divided among five family members, each family member would have at least RM150 government subsidy to spend per month.

In addition, the government could determine whether M40 and B40 income groups are better off after receiving various subsidies in the next three months.

Or else, the government could extend the provision of various subsidies for another three months (i.e., from August to October 2022).

Most importantly, the government has to expedite the distribution of emergency cash aid of at least RM1,000 per flood victim for all those affected by the flash floods in Klang Valley yesterday.

No doubt that Malaysia has a “tighter” fiscal space due to the introduction of numerous stimulus packages worth RM530 billion over the two years of the pandemic.

However, what the rakyat requires now is an empathetic government taking care of their welfare and needs, giving them the opportunity to resume their initial income and earnings back to the pre-pandemic times.

Amanda Yeo is Research Analyst at EMIR Research, an independent think tank focused on strategic policy recommendations based on rigorous research.